Week 9, Trade 9: Add Spot $BNB & $VISTA, $BTC, $ETH & $SOL Options

Opportunity knocks in Sept, trying to maximise while managing risk

📈 Week 9, Lesson 9

“Don’t set a greedy target, but do set a fearless stop” Anonymous

We are into Week 9 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Hashtalk Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

📊 Portfolio Update - Open Trades

Welcome to September. July and August turned out to be specular for us, despite entire crypto market bring sluggish. Our RoI sits at around 50% and about 300% on an annual basis so far. Not bad. We are delighted and we hope we continue to perform even better over the next 52 weeks. Please note, the idea here is to teach basics of trading. Even with 1-2 conviction trades you can actually beat this market. KISS - Keep it Simple Stupid.

In August, we executed eight trades, with two still active. It was an exceptional month, where our strategies outperformed the market-leading cryptocurrencies. Despite the choppy market conditions, we leveraged option selling to successfully generate significant returns. For a detailed breakdown of our trades, you can refer to our previous newsletters or you track our trades and progress live here in our sheet, which provides deeper insights into our August performance.

Here’s the status of our current open trades:

Trade 1: Spot $MOTHER

Status: Holding 75%, Sold 25%

P&L: Currently down by about 45% as market continues to make lower lows. Despite carnage in Alts, $Mother has actually held well around $0.0350 - $0.040 range. However, with partial profits already secured earlier, our exposure is managed. We’re not closing this yet and in fact might add more if we see overall market plummet. Also, we are keeping an eye on signs of rebound in $SOL meme season as Breakpoint Singapore draws closer in 2 weeks.

Trade 2: Spot $SUNDOG

Status: Holding 25%, Sold 75%

P&L: Up by around 350%. We've hit our two profit targets at $0.24 & $0.32 respectively, closing a portion of the position with a solid gain. The remaining position is still in play, with further potential upside on the horizon as market momentum builds. This is the leading memecoin on Tron ecosystem and I don’t think Justin is done yet. We might add some more below $200mn mcap

Trade 3: Spot $BNB

Status: Holding 100%

P&L: Down by around 5%. The market price is currently around $500, reflecting a slight loss. We’re keeping a close eye on this trade, ready to make adjustments based on market conditions and potential catalysts. CZ is certain to be released in Sept and I think that will give this one last push. We will be selling this around $700, assuming overall market does not crash. Otherwise very happy to sit in spot on this one and add more below if market doesn’t recover beyond September.

We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

The U.S. economy shows resilience with no immediate signs of recession, supported by strong GDP growth, decreasing inflation, and a stable labor market.

September is setting up for potential new all-time highs in stocks, especially with expected interest rate cuts in this election year, creating an optimistic market environment for Q4.

Bitcoin whales are accumulating, and institutional interest, notably from BlackRock, indicates potential support and future reversals in the crypto market.

THE BAD:

Historically, September is a challenging month for stocks and crypto, with expectations for a range-bound and consolidating period.

Eurozone struggles continue, particularly in Germany, as declining inflation pressures the ECB to consider further rate cuts, which could lead to negative real interest rates.

THE UGLY:

China’s economic situation is deteriorating with ongoing property market struggles, manufacturing contractions, and rising unemployment, heightening risks of civil unrest.

Significant selling pressure on Ethereum and Solana due to large sales by Jump Trading and shifting meme coin interests to other platforms like Tron.

The U.S. government’s move to sell a substantial amount of Bitcoin from the Silk Road case could increase downward pressure on BTC prices.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 9, Trade 9: ADD SPOT $BNB & $VISTA, OPTIONS ON $SOL, $ETH & $BTC

SPOT $BNB

We've added more $BNB at $500 and set orders to add more at $475, anticipating these levels as excellent entry points should the market experience a pullback. This strategy allows us to effectively reduce the average price of for our overall position in $BNB with imminent CZ release around the corner. After all, “bro took one for the gang”. For an in-depth look at why we're bullish on $BNB and why we've added to our position, check out last week’s newsletter, where we provided a thorough analysis and key insights into the $BNB token: Read the full analysis here.

Additionally, we've revised our Stop Loss for $BNB to $450, acknowledging this as a key support level. This threshold has shown remarkable resilience, even during the market volatility driven by the Yen Carry Trade. Since breaking through resistance in March 2024, $450 has consistently acted as a solid support, further solidifying our confidence in this adjustment

SPOT $VISTA

EtherVista is the new talk of town. It is Pump.fun on Ethereum with small tweaks. It's drawing attention from Solana, the reigning leader of memecoin summer, and Tron, which was positioning itself as the next big blockchain for the memecoin frenzy. However, it seems Ethereum is back in the spotlight, commanding both attention and volume in the space.

Although limited data is available for technical analysis, VISTA’s FDV is significantly lower compared to projects like SunPump, offering a potential 10x upside.

A strategic entry at $20.51 with an exit of initial capital at $40 could allow us to ride the rally. We’re setting three profit targets at $60, $120, and $200, aiming to book profits at each milestone evenly. We are keeping the loss at $10 the first support level that we saw on 4th of September.

SELL $SOL PUTS

$SOL is currently at an attractive market price of around $130 but there are chances that the market might experience a pull back before the rate cut are finally announced by the FED by mid September. We are selling 1000 $SOL PUT at the strike price of $110.

Current $SOL price is at $128. The premium we earn for selling put options is $1.70 for 11 days. That is a monthly return of 3.6% or annualised return of around 43%. We are taking an exposure for a total of 1000 SOL. We earn a total premium of $1,700.

Our strategy is to hold these options until expiry. If $SOL falls below $110, we are happy to buy back 1000 $SOL at $110 for a total of $110,000, because the rebound back to $140 or $160 should be very quick.

Also we took two Solana trades in the past, generating over 25-35% returns which amounted to $13,000. For further details on Solana and why it is under our focus, refer to our previous article here.

BUY & SELL $ETH OPTIONS

$ETH seems to have fallen out of favour, with Vitalik Buterin facing criticism from all sides for selling ETH and seemingly losing touch with the community. However, ETHVISTA seems to be starting a new memecoin season on $ETH. Keeping an eye on that.

GWEI levels are scraping the bottom, reflecting the widespread pessimism.

Ethereum’s daily revenue is lowest in 2024 right now, down by 90% YTD.

Ethereum’s ETF is witnessing a constant fall in volume, causing a ruckus among investors whether it even have everyone’s interest or no

With sentiment hovering near all-time lows, so rather than just shorting $ETH we’re adopting a different strategy of selling and buying $ETH options. This approach allows us to benefit from any upward movement in ETH by capturing potential gains while simultaneously earning a premium. By balancing these positions, we aim to maximize returns in the rangebound market environment. Our strategy is as follows:

Sell $ETH PUT for $58 or 0.0245 $ETH at a strike price of $2,100

Buy $ETH CALL for $39 or 0.0165 $ETH at a strike price of $2,800

Sell $ETH CALL for $13 or 0.0055 $ETH at a strike price of $3,200

All options expire on 27th September

Current $ETH price is at $2386. The premium we earn for selling put & call options is 0.0300 $ETH or $71 & premium we pay on buying the call option is 0.0165 $ETH or $39 for 3 weeks of exposure. That is a net premium of 0.0135 $ETH or $32 which accounts to a monthly return of 1.91% {(32/2386/21)*30} or annualised return of around 23%.

Our strategy is to hold these options until they expire but keeping an open mind here. The net premium we earn from buying and selling the options is $32 for 11 days. We are taking an exposure for a total of 10 ETH. We earn a total premium of $320.

If ETH drops below $2,100, we're comfortable purchasing at that price with limited downside. We anticipate a quick rebound to $2,500, especially if memecoin season picks on $ETH and with Q4 historically being the strongest quarter for crypto.

If ETH rises above $2,800, we stand to gain an additional profit of up to $400 per ETH. Given the minimal downside and potential for profit, this is one of the more favorable trades in the current range-bound market conditions.

BUY & SELL $BTC OPTIONS

This is a risk-neutral strategy on BTC, as buying BTC below $50K is one of the best trades available this year.

Sell 1 BTC Put for $4,088 or 0.0725 BTC with a strike price of $50,000.

Buy 1 BTC Call for $4,005 or 0.0710 BTC with a strike price of $70,000.

Both options expire on December 27th.

The premiums we pay and receive will essentially offset each other, allowing us to benefit from any upward movement in BTC beyond $70,000. If BTC were to drop below $50,000, it would present an excellent buying opportunity.

Our plan is to hold these options until they expire. However, if BTC experiences a significant run-up in October, we may choose to close the position early to lock in profits.

💡 CONCLUSION

The ninth trade of “The 52” is multifold with spot trades on $BNB & $VISTA and the main trade for this week Options on $SOL, $ETH & $BTC

LONG $BNB

Entry 1- $500

Entry Trigger 2- $475

Stop Loss- $450

Take Profit 1- $600

Take Profit 2- $645

Take Profit 3- $705

LONG $VISTA

Entry 1- $20.51

Stop Loss- $10

Take Profit 1- $60

Take Profit 2- $120

Take Profit 3- $200

SELL $SOL PUT

Current market price of $SOL is $128, we are selling 1,000 SOL Put with a strike price of $110. We will earn a premium of $1.70 per option, totaling $1,700 over 11 days. This equates to a monthly return of 3.6% or an annualized return of around 43%. We plan to hold these options until expiry, and if SOL drops below $110, we are comfortable buying 1,000 SOL at $110, as we expect a quick rebound to $140 or $160.

BUY & SELL $ETH OPTIONS

The current price of $ETH is $2,386, and we're trading options on $ETH with an expiry date of September 27th:

Sell an $ETH PUT at a strike price of $2,100 for $58 or 0.0245 $ETH.

Buy an $ETH CALL at a strike price of $2,800 for $39 or 0.0165 $ETH.

Sell an $ETH CALL at a strike price of $3,200 for $13 or 0.0055 $ETH.

The net premium we earn from these trades is 0.0135 $ETH or $32. We are buying & selling 10 $ETH Options. We will earn a net premium of $32 per option, totaling $320 which results in a monthly return of 1.91%, or an annualized return of approximately 23%.

Our strategy is to hold these options until expiration. If ETH drops below $2,100, we're comfortable buying at that level because we believe the downside is limited and expect a quick recovery to $2,500. If ETH rises above $2,800, we could gain an additional profit of up to $400 per ETH.

BUY & SELL $BTC OPTIONS

This is a risk-neutral strategy on BTC, aiming to capitalize on market movements while minimizing risk. The strategy involves selling 1 BTC Put at a $50,000 strike price and buying 1 BTC Call at a $70,000 strike price, both expiring on December 27th.

The premiums nearly offset each other, allowing potential gains if BTC surpasses $70,000, while a drop below $50,000 would be seen as a buying opportunity. The plan is to hold the options until expiration, with the possibility of closing early if BTC surges in October.

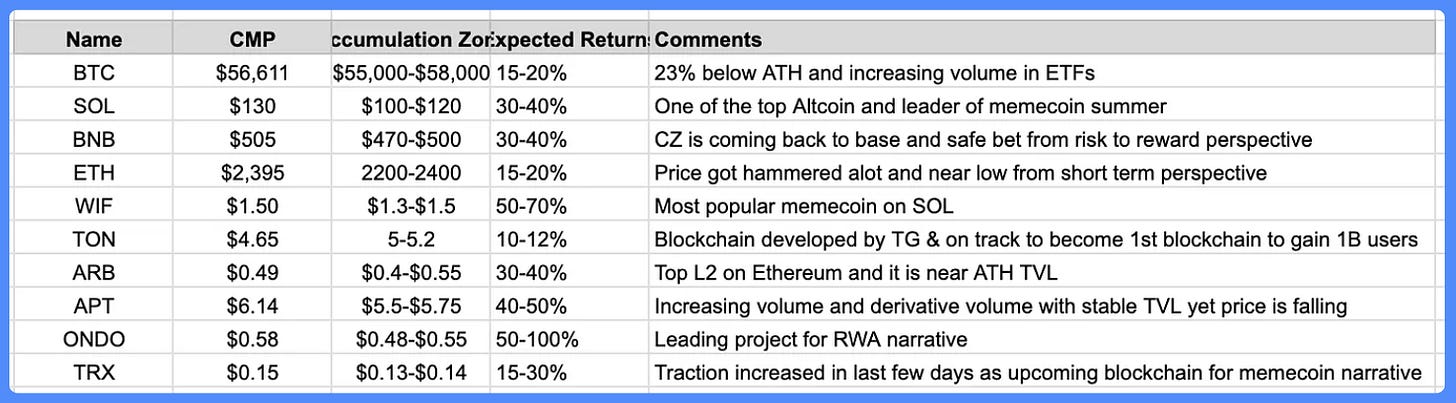

That’s it for this week’s trades. As we continue our research to uncover the best opportunities for our readers, we’ve compiled a watchlist of coins that we're monitoring closely. With the markets trending towards the lower end of the range, we're sharing a sneak peek at the cryptocurrencies currently on our radar. This list could provide valuable insights for identifying potential opportunities in the market.

Stay tuned as we continue to analyze and strategize around these assets.

Stay tuned for more updates and insights!

You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🤝 Discovered a great newsletter this week—”51 Insights” - worth a read!

Looking for a unique perspective on Web3 and emerging tech?

51 Insights is your go-to source. They unpack blockchain, gaming, AI, and data’s impact consumer brands & commerce

Are you a marketer, corporate leader or Web3 builder?

Don’t miss out— Join 10k+ others and subscribe today (🎁 get their top data pack).

⚡️ Unlock Your Advantage with Us

Building a Web3 project or want to sponsor this newsletter? Look no further.

We are your secret weapon for growth. Here’s how we help you succeed:

Engage with our 16k+ community, capturing market and mind share

Blockchain Tech advisory & outsourcing

Craft your narrative and create high-quality opportunities

Build a winning go-to-market and growth strategy

Ready to take the next step? Let’s grow together.

💬 Explore our Free Telegram Channel!

We've a Telegram channel where we daily market trends and alphas, share tweets, threads, and hot from the crypto space.

Join now and be part of our community : https://t.me/hashtalk1