Week 8, Lesson 8

“I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over.” Warren Buffet

We are into Week 8 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Hashtalk Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

Portfolio Update - Open Trades

📈 Portfolio Update - Open Trades

The market continues to consolidate with a small move up over the weekend, as Powell confirmed at the Jackson Hole summit that the interest rates are coming. And with our last week trade on $SUNDOG and the recent up move by the market our returns total returns have increased from 30% to over 55%. Here’s where our current trades stand:

Trade 3: Spot $MOTHER

Status: Holding 75%

P&L: Down 43.54%. We locked in profits on 25% of our position early, which has helped minimize our losses. The remaining 75% is held with a profit target set at $0.09 as we monitor the market closely.

Trade 4: Spot $WIF (Position 1)

Status: Closed

P&L: The market had a good up move but gave up all it gains earlier in the weeks. As the market went we increased our stop loss, which we shared in our Telegram Group. So we ended up closing our position at $1.73 with a modest loss of 6% on the entire position.

Trade 5: Spot $SOL

Status: Closed

P&L: We exited half of our position at $150 earlier this month and as the market had a decent run up over the weekend we added profit trailing level around $150 and ended up closing the remaining position at $152 resulting in overall profit of 28%.

Trade 5: Spot $BTC

Status: Closed

P&L: After exiting half of our position at $58,500, we closed the remaining portion at $62,700 just before the market downturn earlier this week, locking in a total profit of 22.4%.

Trade 5: Spot $WIF (Position 2)

Status: Closed

P&L: We exited half of the position at $1.50, securing gains of over 25%. With the market seeing a solid run-up over the weekend and $WIF surpassing $1.90, we set a profit trailing level around $1.75. This led to closing the remaining position at $1.73, achieving an overall profit of 34.5%.

Trade 6: ETH Options - PUT SELL- $2,300

Status: Holding.

P&L: Neutral. We sold the option at $48.50, and the current price is $0.76 with option still out of money with expiry in few hours. We plan to hold our position until expiration, aiming to close out the full premium of $48.50 per option

Trade 7: Spot $SUNDOG

Status: Holding 25%

P&L: Open P&L up by 396%. We entered at $0.05, and the current price is $0.27. We’ve already closed 75% of our position with significant gains of 466%, and we’re holding the remainder as we target further upside potential.

Trade 7: $ETH Options - PUT SELL- $2,500

Status: Holding

P&L: We sold the option at $73, and it is currently priced at $17.64 with option still out of money with expiry in few hours. We aim to capture the full premium by holding through to expiration.

Trade 7: $ETH Options - CALL SELL - $3,000

Status: Holding

P&L: Flat. We sold the option at $24.90, and it’s currently trading at $0.25. The position remains neutral, and we’ll hold until expiration to capture the full premium.

We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

Quick Macro & Crypto TL;DR

THE GOOD:

FED Signals Rate Cuts: Jerome Powell has indicated that the Federal Reserve is preparing to cut interest rates, a move that has sparked optimism across the market.

THE BAD:

Nasdaq Struggles as Value Outperforms Growth: While the Dow has closed at a record high, the Nasdaq has lagged, highlighting the ongoing rotation from growth to value stocks.

THE UGLY:

Market oversaturation in Altcoins and Memecoins: Despite the overall positive sentiment, the crypto market faces challenges, particularly with the oversaturation of altcoins and memecoins.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

Week 8, Trade 8: Spot $BNB

Why Focus on Binance & $BNB?

CZ is coming back, currently in halfway home: CZ is on his way back to the helm. Currently in a halfway home, CZ's return around 29th Sept is stirring excitement in the market. His influence and vision have always been the driving force behind Binance's success, and with him back at the trading desk, many expect a significant run-up in $BNB. CZ isn't just a leader; he's the soul of the Binance, and his presence alone could reignite investor confidence and market momentum

Many New listings are going to happen on Binance Exchange: After a long drought, Binance is gearing up for a series of new listings. This is huge—new tokens on Binance typically capture massive attention, driving higher trading volumes and rejuvenating user interest. The anticipation of fresh assets hitting the exchange could be the catalyst Binance needs to bring back its trading frenzy

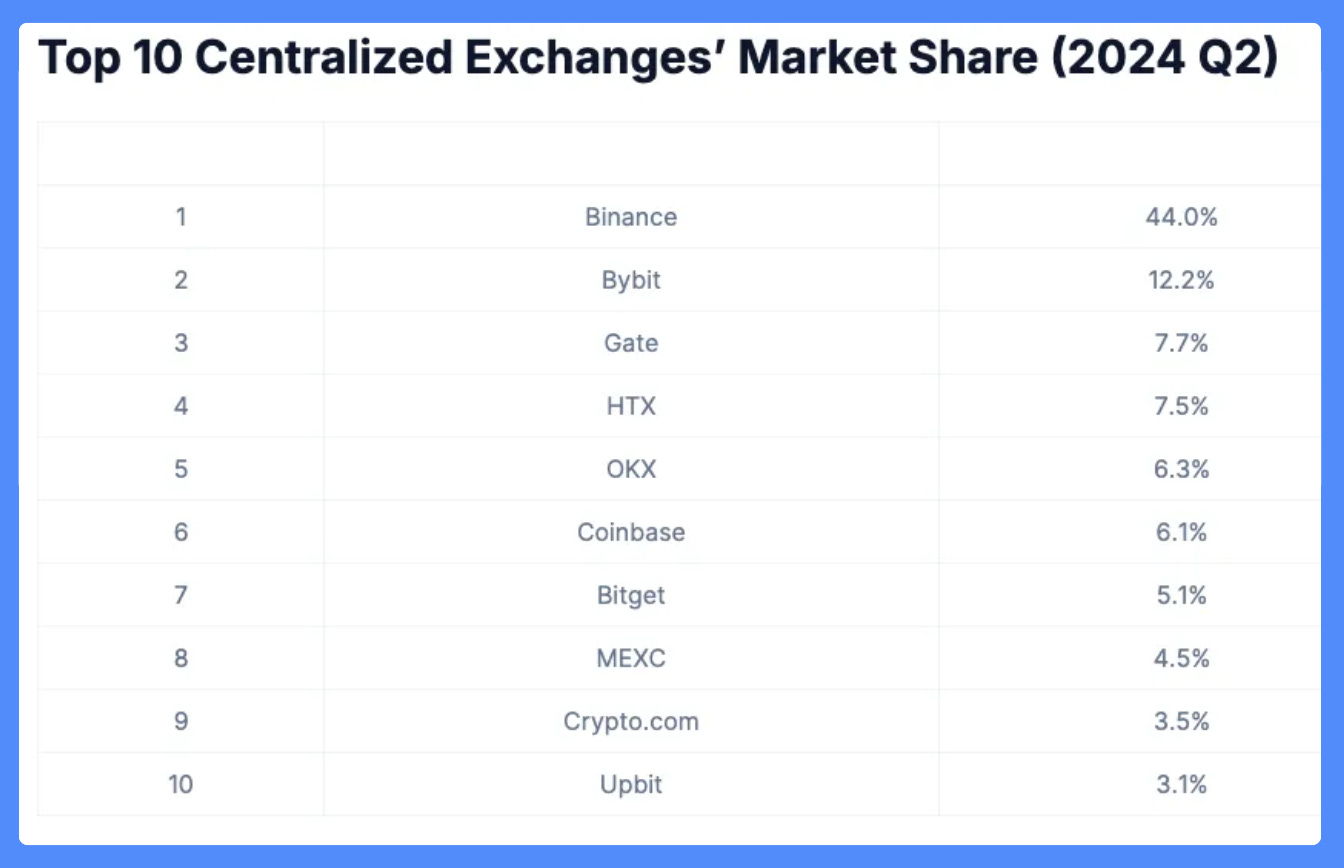

Constant growing volumes: Binance continues to boast over $10B in daily trading volume, even with fewer cryptocurrency options compared to other exchanges. This steady volume is a testament to the exchange's resilience and the strength of users. Despite market fluctuations, Binance's ability to maintain such high volumes signals robust user engagement and liquidity

More Liquidity, More Volume: As global market liquidity is poised to increase, Binance stands to benefit significantly. With the largest user base in the crypto space, any uptick in global liquidity will likely be reflected on the platform, further enhancing its trading volumes and solidifying its market dominance

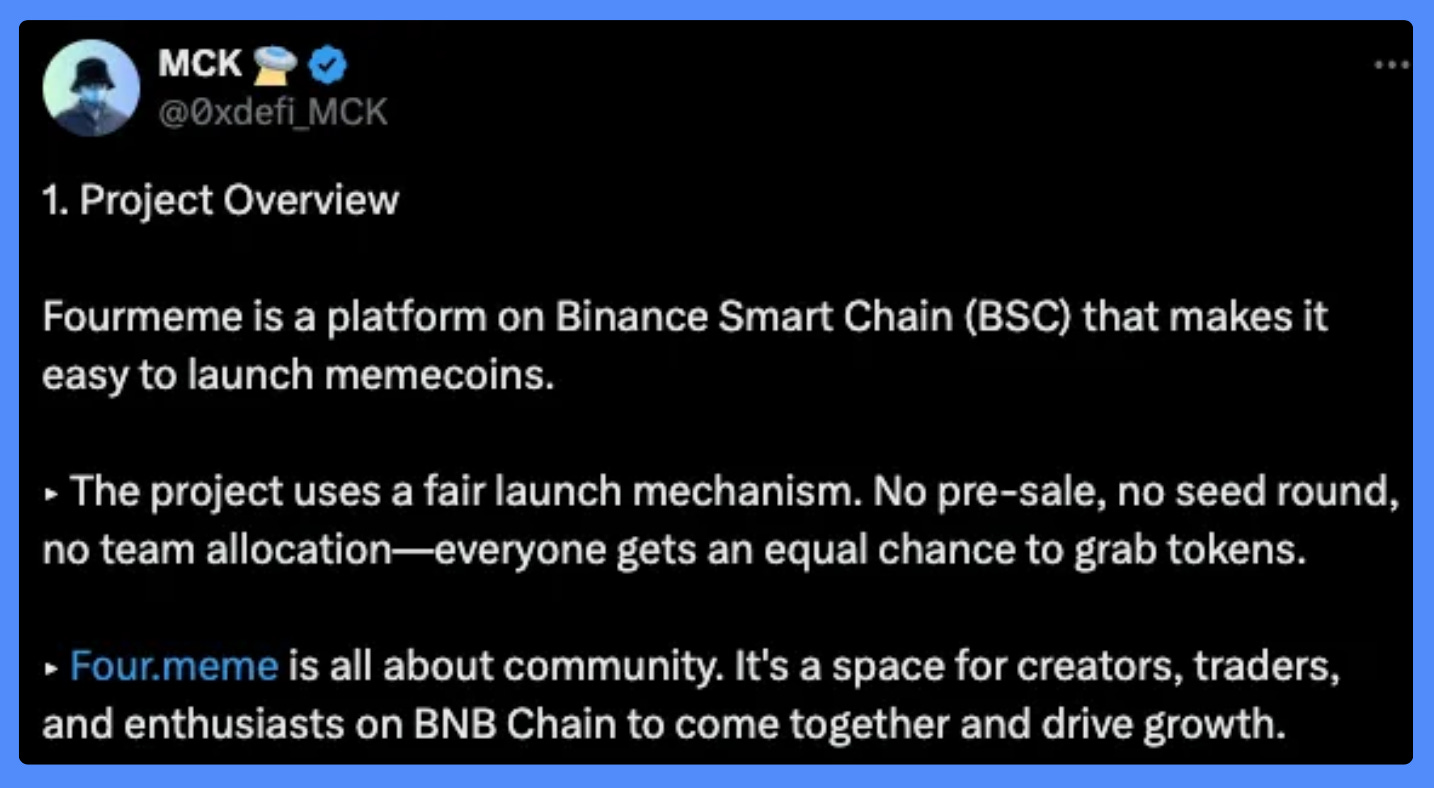

Chance of Memecoin summer on BSC is increasing: The memecoin narrative is currently the hottest in the market, and Binance's BSC is not left out. With platforms like Pump.fun and Sunpump, BSC also got their own memecoin launcher called Fourmeme, there's growing speculation of a "Memecoin Summer" on BSC as few BSC memecoins are getting widely popular like $CAT, $Binancedog, $COCO, $FOUR and more. This trend could indirectly boost Binance's activity and, by extension, $BNB's price

BNB short liquidations outnumber longs: Since the crypto market's downturn on August 5th, BNB has seen a significant increase in price, driven in part by a higher volume of short liquidations compared to long ones. BNB futures market experienced over $7.21M in short liquidations, nearly double the $3.86M in long liquidations. These short liquidations forced traders to buy back BNB to cover their losses, adding upward pressure to price

In summary, Binance is setting the stage for a potential resurgence. Whether it’s CZ’s return, new listings, or the memecoin mania, all signs point to an exciting period ahead for the world’s largest crypto exchange.

Technical Analysis

BNB has been consolidating in a zone from past few months, whenever it tries to move above resistance, it falls back after witnessing profit booking from investors

Keeping it simple and clear, there is a good buying pressure at support levels of BNB therefore buying it at a support and booking profit at different resistance levels

$600 will be an easy target since the CMP is near $540 and it will be a weak resistance as it will be tried to break it for the 3rd time and other factors which are discussed above will push the price higher.

Hashtalk Crypto Trading Framework for $BNB

Here is the link to Crypto Trading Framework and its template that you can follow live

Conclusion

The eighth trade of “The 52” is Long $BNB, it is a medium term trade with a time horizon of 1 to 2 months.

LONG $BNB

Entry Price- $530.7

Stop Loss- $497

Take Profit 1- $600

Take Profit 2- $645

Take Profit 3- $705

Stay tuned for more updates and insights!

You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

Discovered a great newsletter this week—worth a read!

Check out their newsletters, and if you like what you see, consider subscribing!

Our weekly newsletter reaches over 6,500+ readers.

Looking to Sponsor This Newsletter?

Please do not hesitate to message me directly on Twitter : https://x.com/HashtalkSankalp

You can also follow me on Twitter to stay updated on my journey!

Explore our Free Telegram Channel!

We've a Telegram channel where we daily market trends and alphas, share tweets, threads, and hot from the crypto space.

Join now and be part of our community : https://t.me/hashtalk1