Week 1, Lesson 1

'Be Fearful When Others Are Greedy And Greedy When Others Are Fearful'

-Warren Buffett

Here we go. Fifty Two Trades in Fifty Two Weeks. Week 1, Trade 1.

It’s going to be a year long journey. Tighten your seat belts and be ready to ride along. Let’s call it “The 52”.

For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Each week, I am going to pick one area in detail so that we have more than 52 trading related topics covered before we pause for rest. Most trades that we take will be medium (min 1 month) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, but not lose sleep over it.

You can track our trades and progress live here at this Hashtalk Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

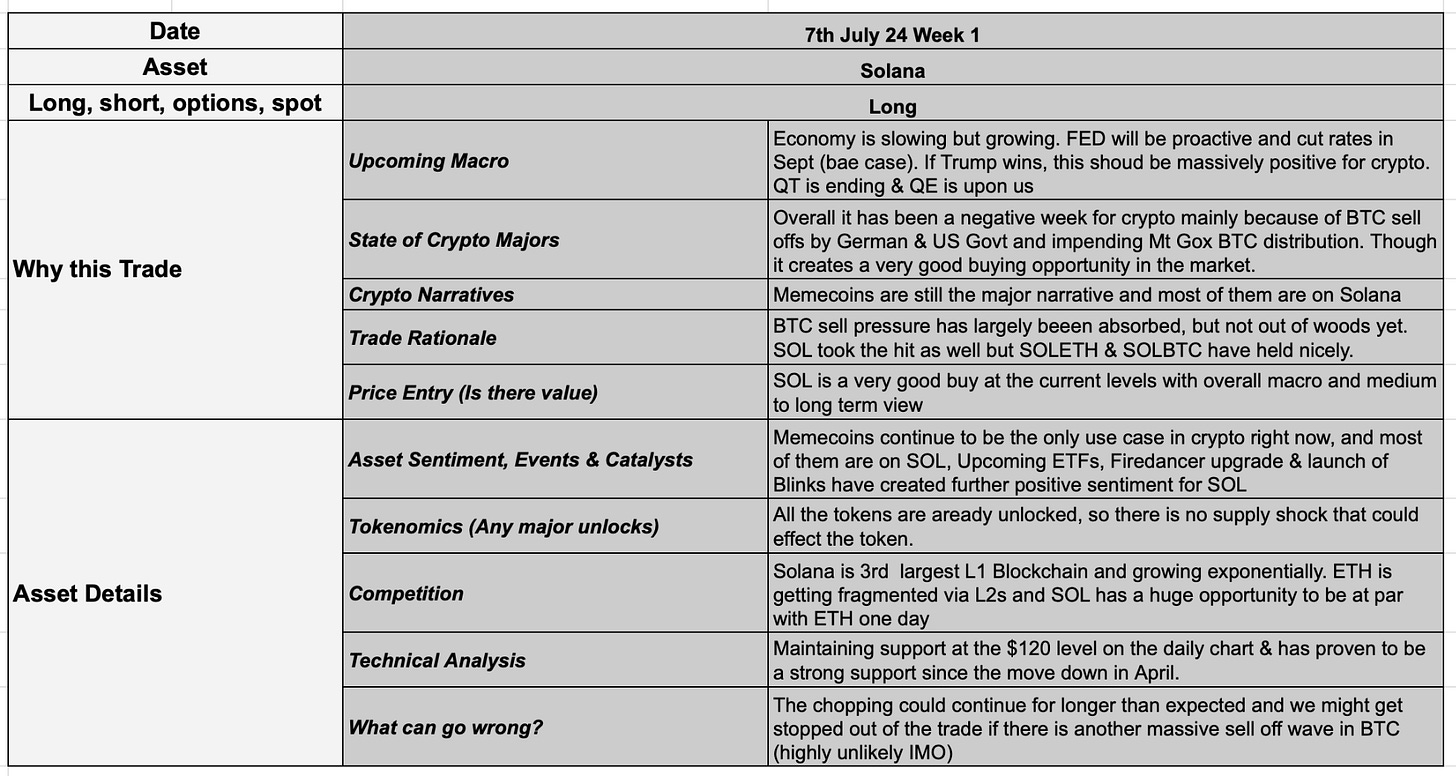

Week 1, Trade 1: Long SOL

Right now, I like SOL more than BTC & ETH for numerous reasons as explained below. I also like some SOL betas and some other ETH betas more than SOL, but current macro and crypto micro structure doesn’t allow me to take too much risk.

I do not want to be short either here in a market that is already down 25%-80% in some cases.

Why I Chose Long SOL

On the macro front, we are in a slowing but growing economy. But I am keeping my eyes on the larger prize here - we are coming off a massive hiking cycle by FED and at some point in next few months, FED is about to start easing again. Other central banks have already started. Global liquidity is already on the rise.

Furthermore, Trump looked solid in the debates and if he wins the presidential cake, there’s cherries for everyone.

One could also take a little more risk and go long some SOL or ETH betas, but with looming supply glut caused by Mt Gox and Germany, no one has any idea how long that would take to clear.

As we approach towards end of Q3 / beginning of Q4, we should see risk assets catch fire as FED cuts rates (my base case) leading to positive real growth. I believe everything rises into that risk curve and crypto should be the biggest beneficiary of that, especially the majors.

And among majors, SOL just stands out as the clear medium to long term winner for me. BTC will continue to be the digital gold and TradFi darling but smart money needs newer shiny things to play with. ETH, on the other hand, should be a sell the news event and “suits” will very quickly move to. We can always take other beta trades next week or rotate some profits from Solana. Markets are vulnerable right now and Solana is very cheap IMO.

Other positive factors down the road for SOL

SOL is going to be a longer to medium term hold for me, not because this is the hottest current narrative, but also for what is about to come in months and years ahead:

Superior Scalability and Performance : already doing up to 710K TPS and aiming for 1 million TPS by 2025 with the Firedancer upgrade. ETH is at 15 TPS

Low Latency and Fees: Transactions on Solana are finalized in about 2 seconds with fees as low as $0.0002, compared to Ethereum's 360 seconds and $2.77 per transaction

Economic Value: Solana achieved a ATH in monthly economic value.

The total revenue generated by a blockchain, including all transaction fees and the MEV captured by validators was at $91.3M in June 2024.

Robust Ecosystem and Adoption: Solana processes 42 million daily transactions compared to Ethereum's 1.1 million, and has 1.6 million daily active users in June versus Ethereum's 387,000. Mainstream Adoption: Major financial players and projects are increasingly adopting Solana. Examples include PayPal's stablecoin integration and growing interest from traditional finance (TradFi) players, revenue from likes of Pump.Fun with aggregate revenue over three months of over $52 million.

Community and Developer Engagement is super active with Superteam playing a very crucial role in that

Memecoin Darling - Solana is the king of blockchains when it comes to launching memecoins - that has single handedly led to this years bull run. Even in this terrible market SOL memes are outperforming everything especially $bonk and $Gigachad

The market cap of Solana is 16.6% of that of ETH - there is room for another 500% upside if Solana does match ETH's market cap

We wrote about Blink that was launched recently and how it is a game changer. You can read more here.

Solana ETF - will probably garner more interest than ETH ETF. Imagine $5-10bn flowing into $SOL by end of year or early next year.

Technical Analysis

SOL exhibits a notable relationship with market volatility. As volatility increases, SOL's price tends to rise, demonstrating a robust response to market fluctuations.

Low Volatility, Declining Price: When SOL volatility is low, its price generally experiences a decline.

High Volatility, Rising Price: Conversely, when SOL volatility is high, its price tends to surge.

Notably, whenever SOL's volatility crosses the 50 mark, it often triggers a significant price increase, marked by a series of green candles. This pattern underscores the importance of monitoring volatility levels for insights into SOL's price movements.

SOL has demonstrated consistent resilience by maintaining support at the $120 level on the daily chart. This support level has proven to be a reliable and help up well since the move down in April.

On the 4-hour chart, SOL has been consolidating around the $140 level. This period of consolidation suggests potential for an explosive upward move, indicating strong momentum and growth prospects for the cryptocurrency.

Hashtalk Crypto Trading Framework

Here is the link to Crypto Trading Framework and its template that you can follow live

Trade & Positioning

The stop loss is $120, the most recent support level from where SOL has bounced twice now since April. I would rather close the trade at $120 than chase it, because below $120 there is an air gap down to $105.

My TP1 is at $165 because if selling pressure abates, $SOL will be the first one to rise, along with its meme coin frenzy. I would like to lock in some profits there but we shall see that closer to date.

“The 52” starting capital is $100,000 and we are risking $2,500 or 2.5% of the starting capital for the first trade and I calculate my position size accordingly.

For our first trade Long SOL, the risk percentage is determined as follows:

Risk % = (Entry Price - Stop Loss) / Entry Price

= (131.50 - 120) / 131.50

= 8.75%

Using this risk percentage, the position size is calculated:

Position Size = Capital at Risk / Risk %

= 2,500 / 8.75%

= 28,600 USDT (rounded from $28,587)

Therefore, we will buy $28,600 worth of SOL. If the price hits our stop loss, we incur a max $2,500 loss. If it reaches our level 1 of take profit at $165, we achieve a 25.5% gain, or $7,285, under the base case scenario. This gives us a base risk/reward ratio of about 2.9:1, with potential for higher overall profit. If the market is very buoyant at that time, we might adjust our SL and TP targets.

Conclusion

The first trade of “The 52” is opening a long position on SOL at $131.50, with a stop loss set at $120 and a first take profit targets at:

Take Profit 1 $165

Take Profit 2 $185

Take Profit 3 $205

The trade size would be of $28,500 with a maximum loss of $2,500. You can track all our trades here.

Investing in Solana presents an opportunity to participate in a rapidly growing, technologically advanced blockchain platform that is outpacing Ethereum in key performance metrics. With its superior scalability, robust ecosystem, and high potential for market cap growth, Solana is positioned as a strong competitor in the blockchain space and offers substantial upside for investors seeking exposure to next-generation blockchain technology.

Thank you and have a fantastic trading day ahead.