📈 Week 13, Lesson 13

“My attitude is that I always want to be better prepared than someone I’m competing against. The way I prepare myself is by doing my work each night.” Marty Schwartz

We are into Week 13 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Hashtalk Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

LOCK & LOADED

📊 Portfolio Update - Open Trades

📈 Portfolio Update - Open Trades

Despite a rocky start to Uptober due to geopolitical tensions, the markets have since recovered and are now moving in the right direction. Here’s where our current trades stand:

Trade 1: $BTC Options – CALL BUY & SELL PUT

Status: Holding the Call and Squared Off the Put

P&L: With no downside risk on this option, we now have unlimited upside potential once $BTC crosses $71,800, and we're confident this will happen before year-end.

Trade 2: $BTC Options – CALL BUY & SELL, PUT SELL

Status: Holding Call Buy & Sell, Squared off Put Sell

P&L: We initially paid a $1K net premium for our options strategy. After closing our put, our net premium increased to $1.5K, limiting downside risk while keeping upside potential open. With options expiring in October, we break even if BTC hits $61.5K and could gain up to $8.5K if BTC reaches $70K.

Trade 3: Spot DRIFT

Status: Sold 100%

P&L: Last week, we exited 50% of our position with a 6% profit. As the market for L1s strengthens, we've observed significant shifts in mindshare from $SOL to other L1s like $SUI and $FTM. This led to a reallocation of demand away from SOL-related plays. $DRIFT was in a price discovery phase when we initially took the trade. However, a small trend reversal caused it to retrace to previous levels, resulting in us closing the remainder of our position at an 8% loss.

Trade 4: $BTC Options – CALL BUY & SELL, PUT SELL

Status: Holding

P&L: The net premium to enter this strategy is zero with a potential upside of 7K if BTC crosses $70K. Whereas the downside would come if the price of $BTC falls below $55K but the time of cycle we are in $BTC at a $55K level would be a very good price to enter.

Trade 5: Spot $SUI

Status: Holding 100%

P&L: Our position is up 10%, with SUI hitting $2.10 before pulling back to $1.82. We're closely watching for a good exit point, so stay tuned on Telegram for real-time updates.

We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

US economy remains strong: 4.1% unemployment, cooling inflation, and a solid jobs market. A 25 bps rate cut is likely after the elections, depending on today's CPI.

China has unleashed major stimulus, lighting up Hong Kong and Shanghai markets.

THE BAD:

China's structural issues—real estate, debt, and weak consumption—are still looming. The stimulus is temporary relief without a plan for long-term demand recovery.

THE UGLY:

Tensions rise as Iran brings heavy firepower into the mix, and the world watches Israel’s next move.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 13, Trade 13: BUY $FTM, $SOL & $MORUD

At the start of this year, L1s were a key narrative, especially with $ETH struggling. The search for the next "ETH killer" began, with $SOL leading the pack. Now, $FTM is gearing up for its Sonic upgrade, potentially matching $SOL in performance. Let’s dive into why we're betting on L1s from previous cycles to hit new highs.

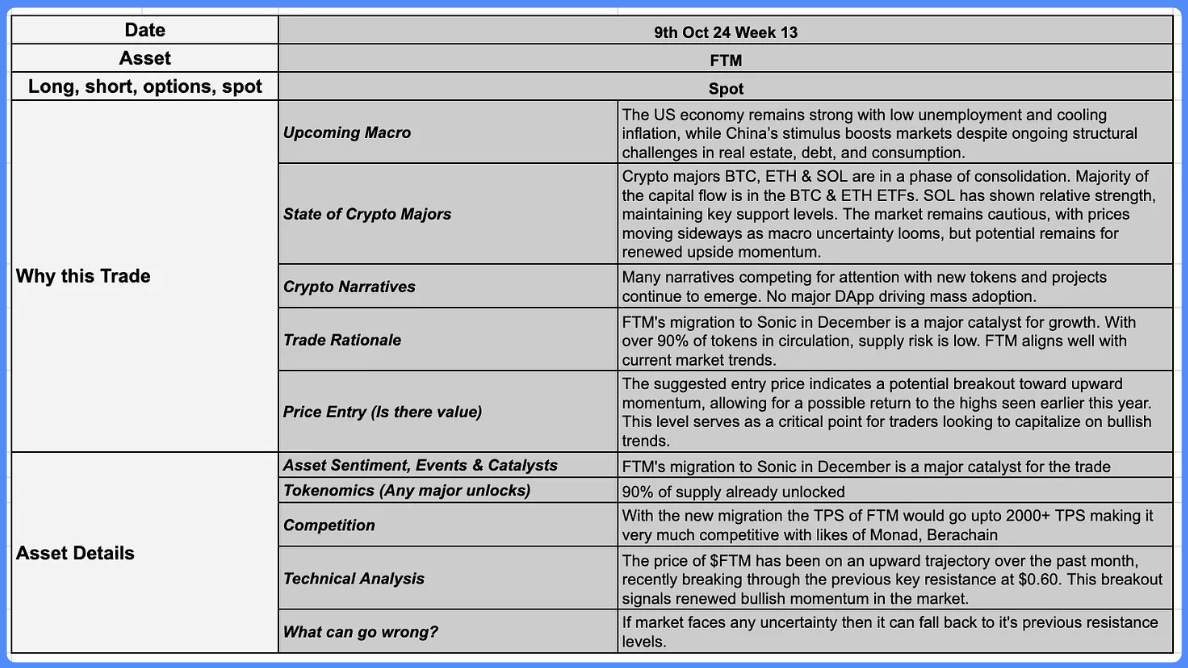

TRADE 1: SPOT $FTM

WHY $FTM?

Limited Supply Risk: With over 90% of FTM already in circulation, there’s minimal risk of major token unlocks flooding the market. This reduced influx of new tokens helps protect against price dilution.

Active Development Team: Even during the bear market, the Fantom team has remained highly active, consistently shipping updates. The upcoming shift to Sonic, set for December, marks a significant milestone in Fantom's evolution.

Strong L1 Narrative: L1s have gained momentum this cycle, with projects like $SOL, $SUI, $SEI, and $TIA leading the way. Fantom’s position as a competitive L1, coupled with its Sonic upgrade, aligns with this trend.

Listed on Major Exchanges: $FTM is readily available on major exchanges such as Binance, Bybit, OKX, and many others, ensuring easy access for both retail and institutional investors.

Upcoming Airdrop Incentive: $FTM/Sonic has announced a major airdrop of 200 million $S tokens to be distributed to eligible point holders. This incentive could drive increased engagement and participation within the ecosystem.

Backed by Andre Cronje: Known for pioneering innovative projects in DeFi. His involvement with $FTM adds credibility, keeps on attracting top developers, and b driving the platform's growth and innovation.

Rising TVL: The excitement surrounding Fantom’s developments has led to a over 40% increase in TVL in last one month, reaching to $109.7 million. This growth signals rising network activity and adoption.

Leading Catalyst: Sonic Migration: The upcoming migration to Sonic in December represents a massive leap forward. Post-migration, Sonic aims to become the fastest EVM-compatible blockchain, boasting one-block finality and the ability to process 2,000+ transactions per second.

Note: All the $FTM tokens post the Sonica migration in December would converted to $S tokens 1:1.

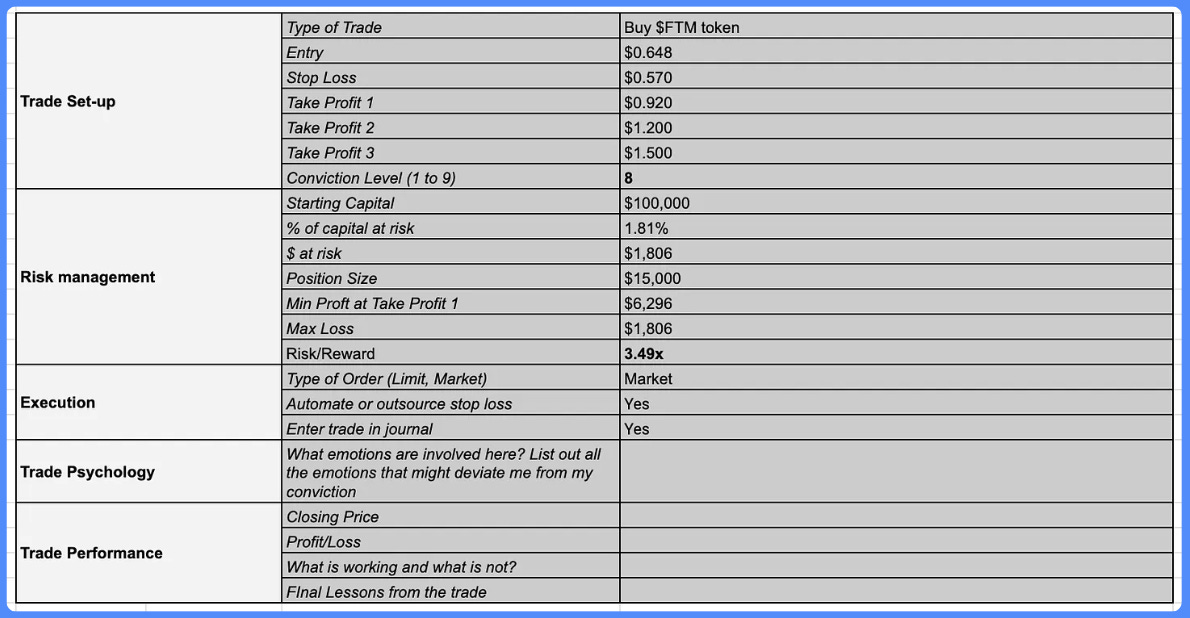

TRADE SET-UP

We are initiating a spot position in $FTM, investing $15,000 at an entry price of $0.648. This is viewed as a short to medium-term trade, with the upcoming Sonic migration expected in less than two months. We anticipate a price surge during this period.

TRADE 2: SPOT $SOL

Since the start of our newsletter, we’ve been consistently bullish on $SOL. As mentioned in our last weeks newsletter, we had placed limit orders below $130 and $125 in case those levels were hit. However, we now believe $SOL is unlikely to fall below $140-$135. As a result, we are entering a position of $5,000 with an average entry price of $140.6.

TRADE 3: SPOT $MORUD

We have been focusing less on memecoins lately and only tend to back those we truly believe in. This one stands out, especially with the strong narrative driven by Murad versus Ansem.

Memecoin plays are very time-sensitive, so be sure to join our Telegram group to stay updated and never miss an opportunity. Here’s the trade we took:

Entry Price: $0.00097

Market cap: $900K.

Technical Analysis

The price of $FTM has been on an upward trajectory over the past month, recently breaking through the previous key resistance at $0.60. This breakout signals renewed bullish momentum in the market.

The next resistance zone is likely between $0.740 - $0.770, where the price could face some selling pressure. However, if FTM breaks through this range in the coming 1-2 weeks, we could see a strong rally toward our first target of $0.92.

On the downside, if the price falls below $0.59, it would invalidate the current bullish setup. As a result, we’ve placed our stop loss just below this level to manage risk in case of a downward reversal.

Hashtalk Crypto Trading Framework for $FTM

Here is the link to Crypto Trading Framework and its template that you can follow live.

💡 Conclusion

The eighth trade of “The 52” is Buy $FTM & $SOL, it is a short to medium term trade with a time horizon of 1 to 2 months.

SPOT $FTM

Entry Price- $0.65

Stop Loss- $0.57

Take Profit 1- $0.92

Take Profit 2- $1.20

Take Profit 3- $1.50

SPOT $SOL

Entry Price- $140.6

Stop Loss- $120

Take Profit 1- $165

Take Profit 2- $180

Take Profit 3- $200

SPOT $MORUD

Entry Price- $0.00097

Stop Loss- $0.00324

Take Profit 1- $0.0109

Take Profit 2- $0.0216

Stay tuned for more updates and insights!

You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

If you loved this, you may subscribe for immediate notifications on our latest episodes!

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!