Week 12, Trade 12 : BUY & SELL $BTC Options, Long $SUI

UPtober to REKTober, dreams shattered, but umpteen opportunities as we enter liquidity filled Q4

📈 Week 12, Lesson 12

“A small profit is better than a big loss” Ron Rash

We are into Week 12 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Hashtalk Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

📊 Portfolio Update - Open Trades

Welcome to Uptober, everyone! Oops, Rektober by the time I am publishing this.

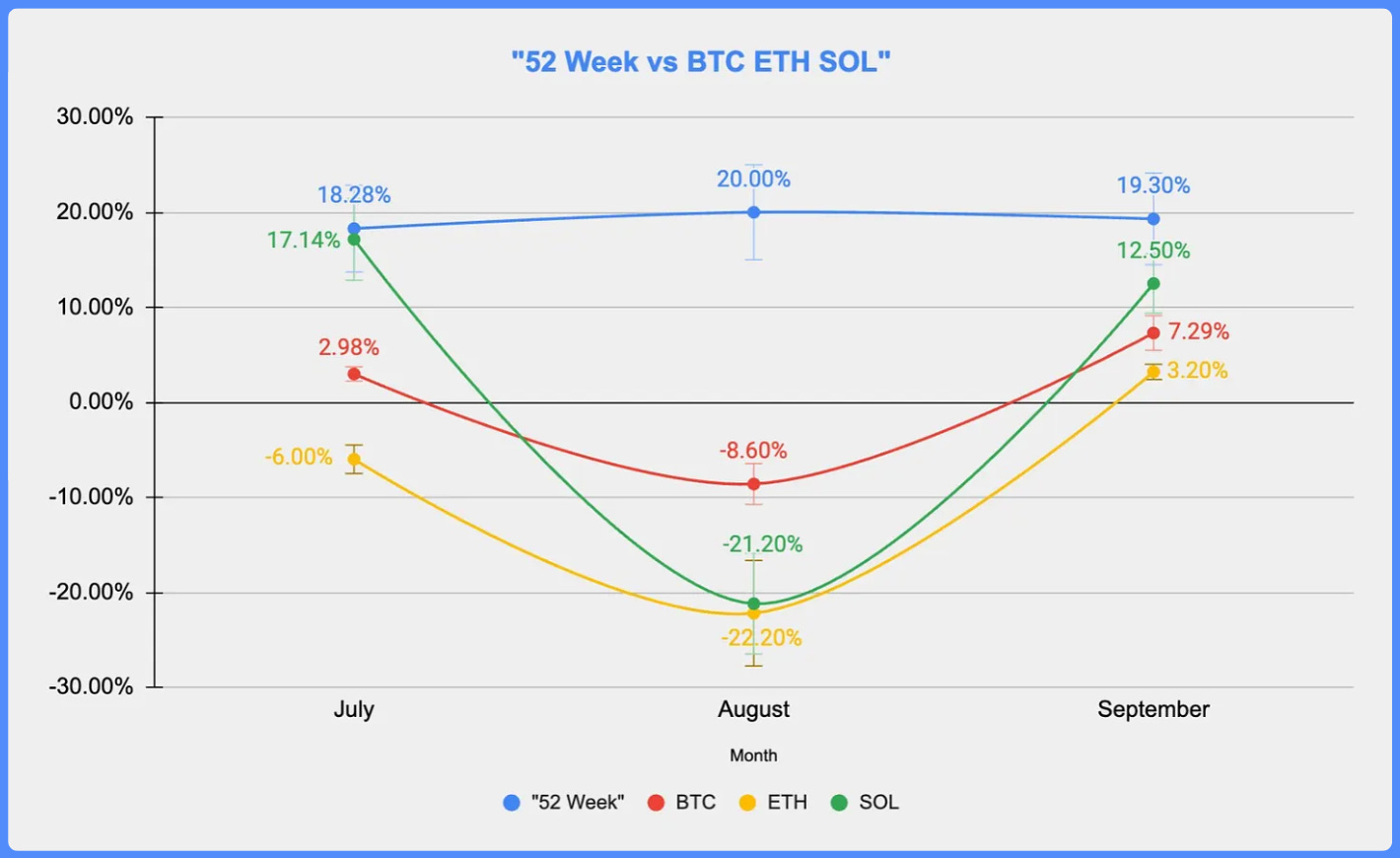

Q3 has been nothing short of a fantastic quarter for us. We bow and we take a victory lap when most traders have bled. But we stay humble, we stay focussed and we continue ot book profits till we see clear signs of a BULL. With Bitcoin delivering a 1.70% return in the last quarter, we've managed to achieve a total return of over 256% per annum and a massive RoI of 69%.

As we enter the final quarter of the year, fresh opportunities are on the horizon, offering us a chance to elevate our returns even further. Historically, Q4 has been one of the most profitable for crypto. With the average returns being over 80%. Bu with geopolitical tensions looming, we decided to be careful.

The market was euphoric earlier this week and we closed most of our trades on Monday as transparently laid out on our TG channel. It has been on a downtrend since 1st October, coupled with rising tensions in the Middle East. We close more earlier on. Below is a detailed breakdown of our current open trades:

Trade 1: Spot $MOTHER

Status: Sold 100%

P&L: We closed the remaining 25% of our position at $0.134, bringing our total profit to over 72%. We had already closed 75% last month in week 9 I think.

Trade 2: Spot $SUNDOG

Status: Sold 100%

P&L: This was one of our riskier trades, which we’ve now closed entirely, securing a total profit of nearly 500%. This was a good trade. We are closing this out of fear of all blown out war although $SUNDOG has held very well around $300.

Trade 3: Spot $BNB (Entry: $530.70)

Status: Sold 100%

P&L: Following CZ's release from jail and the rising Middle East tensions earlier this week, BNB experienced a dip. Our trailing stop was triggered at $575, and we exited the position with a profit of over 11%

Trade 4: $BTC Options – CALL BUY & SELL PUT

Status: Holding the Call and Squared Off the Put

P&L: We bought a call option and sold a put option expiring later this year. After the market's strong rally, we closed our put position at $1,800, reducing the effective cost of the call to $1,800. With no downside risk on this option, we now have unlimited upside once $BTC surpasses $71,800, and we're confident this will happen before year-end.

Trade 5: Add Spot $BNB (Average Entry: $487)

Status: Sold 100%

P&L: Similar to our first BNB trade, our trailing stop was hit, and we closed the position with a profit of over 21%

Trade 6: $BTC Options – CALL BUY & SELL, PUT SELL

Status: Holding Call Buy & Sell, Squared off Put Sell

P&L: We initially paid a net premium of $1K to enter our options strategy. With BTC surpassing $63K last week, we closed our sold put, reducing our net premium to $1.5K and limiting our downside risk. This move keeps our upside potential open, and with options expiring in October, we’ll break even if BTC closes at $61.5K, with a maximum possible return of $8.5K if BTC reaches $70K. You can find the detailed calculations in our sheet.

Trade 7: Spot DRIFT

Status: Sold 50% Holding 50%

P&L: We closed 50% of our position at profit of 6%, while we hold the remaining 50%

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

The FED is recalibrating as a new macro rate-cutting cycle begins. The market has pushed them to deliver a 50 bps cut, and the FED delivered.

The Fed forecasts a total of 200 bps in cuts by the end of 2025.

Global monetary liquidity is increasing at over 6% annually, marking the fastest growth since April 2022 and aligning with the four-year cycle.

THE BAD:

If the upcoming payroll numbers exceed 4.4%, it would likely raise alarm bells. While they currently appear to be in line with expectations, frequent revisions have undermined their credibility.

European Economic Struggles: European PMI continues to decline, dropping to 48.9 from 51.0, led by Germany.

THE UGLY:

Recent Chinese data has sparked concerns that China might begin exporting disinflation to other countries, including the U.S.

Geopolitical Risks Looming Over Markets: Escalating geopolitical tensions, particularly in the Middle East, pose a serious threat to global markets as Iran has attacked Israel officially on Tuesday.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 12, Trade 12: BUY & SELL $BTC OPTIONS

Market looks very heavy at the moment. Here are some of my thoughts from our Hashtalk TG Channel.

The problem in crypto is that most of the gains are just in memes. Otherwise it all seems driven by market makers. One can hardly catch a SUI or TIA or any other Alt wave. Gains are limited. Might as well trade NIVIDIA or some AI stock. Smart money is stuck to S&P & QQQ’s which are touching ATH’s. Why invest in crypto? And crypto drawdowns are worse vs TradFi. Then who is making money - the house always makes money. The trading venues, the “market makers working with projects”, infra for memes like pump fun, FOMO3D etc.

Even memes are so dispersed now. Pure gambleFi. Including Solana. Super diffcult to make money there. Very exhausting. There are little mafia everywhere who keep pumping the coin and sell bit by bit along the way. Whenever there is a major drawdown happens, they all sell and get away. Numerous examples of this every week.

It is also a function of range bound prices in majors. Until we see BTC move back above 70K, that Euphoria will not come back. And that is when next leg, and new narratives will born. So what are the catalysts for that?

I think this could be the last draw down before elections. Soon war will be “normalised” and Uptober songs will rain from Gods above. And election mania will take over the entire world and media. I am of the view that Trump will win, and that is the catalyst that takes us close to 90K and then we pause depending on what Trump announces next. But future bull seasons for Alts wont last longer than few weeks. We keep rotating as new high FDV coins keep launching. Same old oration except that money is just rotating from old Alts to new Alts and new memes. Not from BTC to ETH to Alts to Shitcoins anymore. Catch the wave or miss it for the next one. Either you are a gambler or you hang with the right crowd.

Meanwhile we have executed combination of selling and buying options based on the belief that BTC could break below $55K, and if it does, $55K is an attractive entry point for a long-term position. I’ve structured the trade to make it zero premium, leaving leave room for upside BTC rallies.

TRADE 1 SETUP - BTC Options for 29th November. Current Spot @ $61K:

Sell BTC Put Option at $55K – Premium Collected: +$2,650

Rationale: If BTC drops below $55K, its a good buy, now that we are in the last quarter with the elections around the corner, I believe it is up only from here on out, once war settles.

Buy Call Option at $63K – Premium Paid: -$4,600

I am counting on things to settle down and markets to rally post-elections. While the market may see a pull back because of the middle east tensions, that should be short lived. If BTC breaks above $63K, I’ll be well-positioned to capture that upside.

Sell Call Option at $73K – Premium Collected: +$1,950

To offset the cost of my long call and manage risk, I’ve sold a call at $73K. As mentioned earlier, I expect the market to rise and hover around the all-time high of $74K, with a potential breakout post-elections in November. While this caps my upside above $73K.

All Options Expire on 29th November and we may close the trade as we reach closer to $70K.

Risk and Reward:

Premium Paid: By selling the put at $55K and the call at $73K, I’ve collected a total of $4.6K in premium. Since the $63K call cost $4.6K, my net premium comes down to zero.

Upside Potential: If BTC rallies between $63K and $70K, I could gain an additional $7K.

Downside Risk: The primary risk is if BTC drops below $55K, at which point I’d have to buy at this level. However, I believe this is an attractive entry point for $BTC, aligning with my long-term outlook.live

TRADE 2 SETUP - Long $ SUI Spot

Fortunately, for us as you can see on our LIVE Hashtalk Trade Link, we are sitting on a massive e cash pile waiting for Q4 and dips like this. We wish to start deploying that now. Bit by bit for now.

We are starting with SPOT $ SUI for $10,000 at an entry price of $1.80. We are seeing a face off between $ SUI and $ Solana but $ SUI has held very well in this dip and that gives us more confidence. Although just to be clear, $SOL for us is a clear winner in the medium to long run. This is a very short term trade for us.

We are also putting a limi order on $Solana below $$130 and below $125 in case the levels are hit.

Solana is $ ETH killer and up by almost 10X this year. If there is any competition to Solana as a killer even remotely, then it is $ SUI. But we will be keeping our stops tight even on this SPOT SUI trade. You never know with these market makers :)

💡 CONCLUSION

In this week’s trade recap, we’re reviewing a recent BTC options play that netted us a tidy premium and some room for flexibility as the market moves. Here's how it panned out:

Sell Put Option at $57K: This nets us a premium of $1.4K, acting as the core income generator in the trade. By selling this put, we’re betting that BTC will remain above $57K by expiration.

Buy Call Option at $63K: This leg represents our upside exposure. While it cost us $5K, it positions us for profits if BTC climbs above $63K.

Sell Call Option at $70K: By selling this call, we collect another $3.7K, capping our gains above $70K but reducing some of the cost of the previous call purchase.

All the options are expiring on 29th November

Net Impact:

We're paying a net zero premium on these trades.

If BTC rallies, we stand to gain an additional $7K as our upside exposure between $63K and $70K remains intact.

The 11th trade of “The 52” is Long $DRIFT, it is a medium term trade with a time horizon of 1 to 2 months.

LONG $ SUI

Entry Price- $1.82

Stop Loss- $1.50

Take Profit 1- $2.50

Take Profit 2- $2.75

Take Profit 3- $3.00

OTHER COINS THAT I AM WATCHING CLOSELY THIS WEEK

Assuming BTC holds and doesn’t crash on us

More $ SUI

$ SAGA below $2

$EIGEN - target below $2.75

$TON below $4.50

$POPCAT - below $0.650

$ SEI below $0.35 - I like this one, this could be next $ SUI

$WIF below $1.5 is a screaming buy

$INJ below $15

$MOTHER below $0.75 and then all the way down to $0.40 - will bounce back good

Give me your fav coin - comment here.

Stay tuned for more updates and insights!

You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🤝 Discovered a great newsletter this week—worth a read!

Check out their newsletters, and if you like what you see, consider subscribing!

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

If you loved this, you may subscribe for immediate notifications on our latest episodes!

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!