📈 Week 37, Lesson 37

"The market rewards discipline, not intelligence." – Mark Minervini

We are into Week 37 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

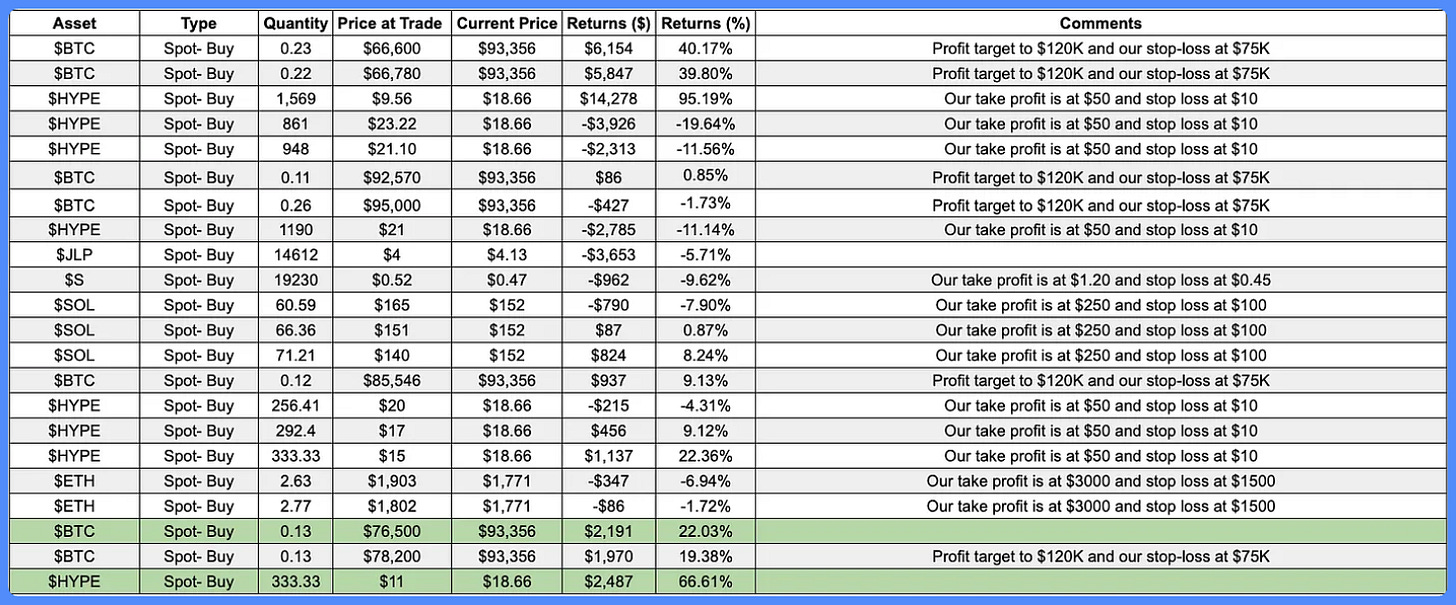

📊 Portfolio Update - Open Trades

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

UNDERSTANDING & AVOIDING FOMO

Fear of Missing Out (FOMO) is one of the most dangerous emotional traps in trading. It’s that anxious feeling you get when you see a market move sharply without you, and you jump in too late—often right before a reversal. Acting on FOMO leads to impulsive decisions, chasing price action, and abandoning your trading plan. In short, FOMO trading turns your strategy into a gamble.

The market will always create opportunities—but not every opportunity is yours to take. The best traders learn to let go of missed moves and stay focused on high-quality setups that match their plan. Trying to catch every wave usually results in overtrading, poor risk management, and emotional burnout. Discipline means waiting for your setup, not reacting to someone else’s win.

How to Beat FOMO in Trading:

Have a Clear Plan – If a setup doesn’t meet your rules, skip it. Let logic, not emotion, guide your trades.

Use Alerts & Automation – Set alerts for your key levels or automate your strategy to reduce emotional decisions.

Track FOMO Trades – Keep a journal and tag every trade you took out of FOMO. You’ll quickly see the damage it causes.

Zoom Out – Look at the bigger picture. Missing one trade means nothing over the course of 100+ trades.

Practice Gratitude – Be okay with not catching every move. Focus on process, not perfection.

In trading, discipline is more profitable than excitement. Avoiding FOMO keeps your head clear, your strategy intact, and your capital protected.

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

China's Q1 GDP beat expectations at 5.4% - Driven by strong industrial production and frontloaded exports, this momentum could help cushion tariff shocks temporarily.

ECB rate cuts provide support - With rates now at 2.25% and more cuts signaled, monetary easing could help Europe weather the demand shock from rising U.S. tariffs.

AI remains a secular growth driver - U.S. and Japanese equities benefit from the AI buildout, even as tech volatility increases; strategic investors are still overweight AI themes.

THE BAD:

Tariff exemptions bring more confusion than relief - Some tech imports were spared, but unpredictability is stalling business investment and planning.

Credit markets show deep stress - Record outflows from credit funds and frozen issuance signal investors are bracing for recession despite stable spreads.

Treasuries lose their "safe haven" status - Yields spiked to 4.34%, but rising debt and foreign outflows in USA show that Treasuries may no longer offer portfolio stability.

THE WORSE:

The U.S. dollar drops sharply - Despite higher tariffs, the dollar hit a three-year low as global investors grow wary of policy volatility and fiscal risk.

Stagflation is becoming a real threat - With Yale forecasting a 2.9% inflation boost from tariffs, consumer CPI could top 5%, slashing household purchasing power by nearly $5,000.

Global supply chains face renewed pressure - Electronics and autos see partial relief, but steel, aluminum, and critical inputs remain deeply exposed to disruption, which will lead to inflation.

Rising tension between India & Pakistan - After terrorist attack in Pahalgam, India. India has taken strict steps and suspended the Indus Water Treaty which makes Pakistan vulnerable to their 60-80% agriculture water supply.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 37, Trade 37 : $BTC, $HYPE & $SOL

PROFIT BOOKING & RE-ACCUMULATE NEAR SUPPORT

Markets have finally cooled off a bit, and for once, it feels like we’re not staring down the barrel of another financial doomsday headline—at least not immediately. Most of the bad news has been priced in, with macro fears, policy uncertainty, and rate hike drama largely digested. What we’re seeing now is cautious optimism. It’s that awkward moment in the movie when the villain pauses and everyone hopes it’s finally over... but you’re still not putting your popcorn down just yet.

Bitcoin’s trading in a move to a new trading critical zone for now—between $85K and $95K. It’s holding for now, but if we fall through $85K, things could get spicy fast. A flush down to $75K is on the cards, albeit a low-probability one. If that happens, it likely means some negative news has hit the market - think major geopolitical tension or some surprise out of left field in global finance. But until that fire alarm rings, the market is holding its breath and hoping for something better.

On the upside, if BTC manages to clear $96K and sustain it, we could be looking at the beginning of a mini bull run. Think of it like seeing sunshine after a week of rain—everything suddenly looks better, and you can almost hear the altcoins getting ready to moon. But let’s not get ahead of ourselves. This market still has a short fuse. One poorly timed Trump tweet or unexpected macro shock could put the brakes on quickly. You know how it goes - up only until someone mentions tariffs.

Right now, we’re playing it safe. We’ve booked profits and are sitting on the sidelines, eyeing our watchlist like hungry shoppers waiting for a flash sale. The goal? Accumulate strong tokens at lower levels when the inevitable dip comes. We’re not panicking, we’re planning. Because the market always comes back around, and when it does, we’ll be ready to load up with more conviction—and hopefully, less FOMO.

For the full breakdown of our market strategy and thesis—past, present, and future—check out our in-depth quarterly report:

Trade 1: $BTC

Sold at: $93,356

Reaccumulation Zone: $85,000

BTC is showing signs of exhaustion near recent highs and is struggling to maintain momentum above $04,000. A correction could bring it down to our re-entry zone. Though a break below $84,000 level could lead a quick flush down to $75,000 which would serve as our 2nd buying so we are able to lower our entry and it aligns with previous demand zones and offers a strategic opportunity to re-enter before the next leg up.

Trade 2: $HYPE

Sold at: $18.66

Reaccumulation Zone: $13 – $15

HYPE is currently overextended after a steep climb. We expect a short-term correction, especially if volume dries up. The initial support is around $14 though if $BTC breaks $85,000 everything else would follow, so our 2nd buy would be place around $10 zone which has previously acted as a base, making it a solid accumulation zone and averaging out our entry.

Trade 3: $SOL

Reaccumulation Zone: $130– $135

SOL is facing resistance after a strong rally and could follow broader market weakness. If it dips below $130, we accept it would go down to $100-110 where we execute our 2nd buy to lower in our average entry.

💡 CONCLUSION

The underlying macro backdrop continues to present a mixed picture—while rate hike fears have cooled and most policy uncertainties appear priced in, lingering risks remain. These include renewed geopolitical tensions, potential regulatory surprises, and a possible return of tariffs that could spook markets once again.

Given this environment, we've taken a defensive stance—exiting into strength and preparing to deploy capital at more attractive levels. This strategy is rooted in discipline: reduce risk near overextended zones, maintain dry powder, and rotate back in when conditions align with our technical and macro thesis.

Strategic Trade Levels:

Bitcoin (BTC):

Profit booking: Above $93,500

Reaccumulation Zone: Below $85,000

Solana (SOL):

Profit booking: Above $150

Reaccumulation Zone: Below $130

Hype (HYPE):

Profit booking: Above $18

Reaccumulation Zone: Below $14

Stay tuned for further updates, and remember—NFA (Not Financial Advice), always DYOR (Do Your Own Research) before making investment decisions! You can track all our trades here.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!