📈 Week 34, Lesson 34

"The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance."– Ed Seykota

We are into Week 34 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

📊 Portfolio Update - Open Trades

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

MASTERING THE PSYCHOLOGY OF PATIENCE & DISCIPLINE

Successful trading isn’t just about technical skills—it’s about mental discipline. Many traders lose money not because of bad strategies but because they lack patience and emotional control. The market rewards discipline and punishes impulsiveness. Learning to wait for high-quality setups instead of chasing trades is a key factor in long-term success.

Impatience leads to overtrading, revenge trading, and entering poor setups, while discipline allows you to stick to your strategy, follow risk management rules, and avoid emotional decision-making. The best traders understand that trading is a game of probabilities, and not every trade will be a winner. Accepting losses as part of the process and staying focused on consistency over time is what separates professionals from amateurs.

How to Strengthen Your Trading Discipline:

Follow a Trading Plan: Having clear entry, exit, and risk management rules removes guesswork and emotional influence.

Wait for High-Quality Setups: Avoid the urge to trade constantly; focus on setups that align with your strategy.

Manage Emotions: Recognize when fear or greed is influencing your decisions and step back if necessary.

Take Breaks: If you feel frustrated after a loss, walk away and reset your mindset before trading again.

Review Your Trades: Keep a trading journal to track mistakes and refine your psychological approach over time.

Discipline and patience turn an average strategy into a profitable one. The traders who control their emotions and wait for the best opportunities win in the long run.

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

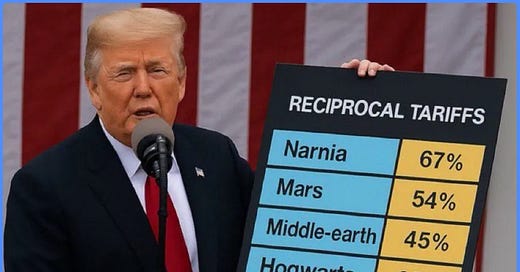

Policy Revenue & Reshoring Potential: Trump’s sweeping reciprocal tariffs (50+ countries, 10% baseline, 25% on autos) may boost U.S. revenue and drive domestic production reshoring for long-term competitiveness.

Fiscal Signal for Growth: Promises of the “largest tax cut in U.S. history” could eventually stimulate economic growth, offsetting near-term trade shocks.

THE BAD:

Market Volatility & Investor Caution: Sharp stock sell-offs in the U.S. and Europe reflect heightened uncertainty over tariff impacts and softening consumer demand amid weak economic data.

Consumer Confidence & Spending Hit: Falling consumer sentiment—reaching 12-year lows—combined with rising PCE inflation and muted spending, points to deteriorating short-term economic outlook.

THE WORSE:

Deepening Trade & Fiscal Uncertainty: The aggressive, widespread tariff wave and potential reciprocal measures risk disrupting global supply chains and triggering long-lasting recession fears.

Stagflation & Policy Gridlock: Persistent inflation, limited Fed flexibility due to tariff-driven cost pressures, and a fragile fiscal environment could lead to a dangerous stagflation scenario.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 34, Trade 34 : HODL & DCA $BTC & $SOL

World Liberation Day might sound like the start of a global celebration, but in the trading world it signals a seismic shift. Under President Trump’s watch, tariffs have become the new currency of negotiation—a bold, if controversial, tool intended to recalibrate decades of free trade practices.

In essence, Trump’s approach is designed to pressure trade partners—from Canada to China—to lower their own tariffs and “level the playing field.” The administration argues that these measures help protect American jobs and reduce trade deficits. Yet, in practice, these tariffs often ripple through supply chains, impacting prices and market dynamics in unexpected ways.

The challenge for traders is twofold. First, tariffs act like an extra cost on every imported good, potentially raising consumer prices and disrupting established supply chains. Second, while the goal is to spur reciprocal concessions, history suggests that reversing such policies is a long and complicated process. Once imposed, tariffs tend to become entrenched, leaving negotiators with the difficult task of untangling a web of economic interdependencies.

Ultimately, the real question is whether these tariffs will yield the desired concessions from trade partners—or if they will simply add another layer of uncertainty to global markets. As the trade landscape continues to evolve, traders must remain agile, closely watching not only policy announcements but also the broader economic signals that indicate when and how these tariffs might finally be eased.

Amid this backdrop of uncertainty, the market appears to be entering a corrective phase. Our analysis has pinpointed strategic entry points for $BTC and $SOL as potential beneficiaries of a rebound from key support levels.

1. LONG $BTC:

Entry Orders: Staggered limit orders at $78,000, $76,000, and $74,000 to refine the average entry price.

Stop Loss: $60,000

Take Profit Levels: Targets set at $88,000 and $95,000 to capture gains during upward swings.

Rationale: BTC has recently flirted with the $80,000 support level. A sustained drop below this mark could trigger accelerated losses toward long-term support near $76,600. Positioning ourselves at these entry points allows us to benefit from a potential bounce as market sentiment regains strength.

2. LONG $SOL:

Entry Orders: Limit orders positioned at $110 and $105 to accumulate near robust support zones.

Stop Loss: $100

Take Profit Levels: Targets at $150 and $180 to exploit possible price recoveries.

Rationale: SOL has slipped below the $115 support level amid a broader market pullback. By setting entry orders in this vicinity, we aim to capitalize on a potential recovery as the market finds stability.

💡 CONCLUSION

In light of recent developments, including the implementation of substantial tariffs by the U.S. administration, the global financial markets have experienced significant volatility. These tariffs, which impose a 10% baseline on all imports and higher duties on specific countries, have raised concerns about potential economic downturns and increased inflation.

Given these market conditions, we have identified strategic entry points to capitalize on potential rebounds:

LONG $BTC: Entry Orders: Staggered limit orders at $78,000, $76,000, and $74,000 to refine the average entry price.

LONG $SOL: Entry Orders: Limit orders positioned at $110 and $105 to accumulate near robust support zones.

Stay tuned for further updates, and remember—NFA (Not Financial Advice), always DYOR (Do Your Own Research) before making investment decisions! You can track all our trades here.

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!