📈 Week 25, Lesson 25

“If you can't take a small loss, sooner or later you will take the mother of all losses.” – Ed Seykota

We are into Week 25 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

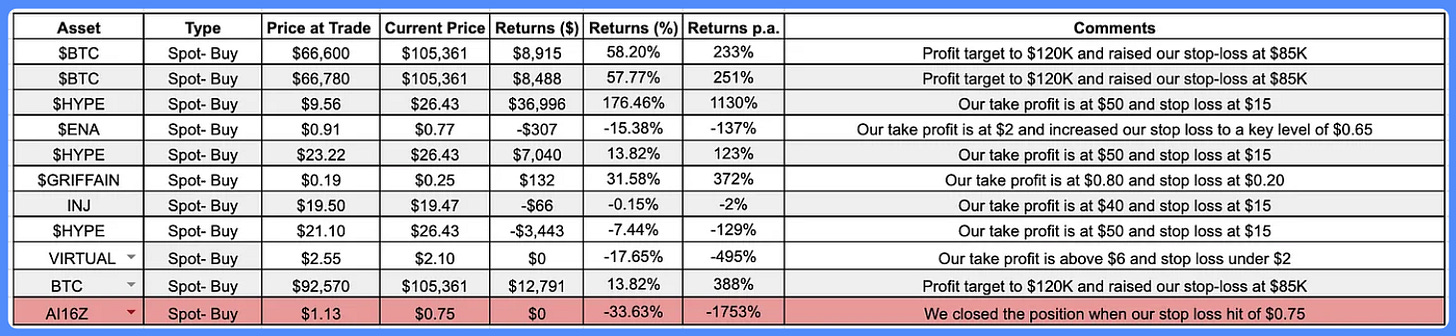

📊 Portfolio Update - Open Trades

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.

We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

IMPORTANCE OF TRADING PSYCHOLOGY

Successful trading isn’t just about strategy and analysis—it’s also about mastering your emotions. Fear, greed, and impatience can lead to impulsive decisions, like panic-selling during market dips or chasing trades out of FOMO. Learning to stay disciplined and stick to your trading plan, even in volatile conditions, is what separates profitable traders from those who struggle.

Emotions like fear and greed can cloud judgment and lead to erratic decision-making. Fear, for example, might cause you to exit a position too early, fearing a loss that may not happen. On the flip side, greed may push you to hold a position for too long, hoping for bigger profits, only to watch the market reverse. Impatience can lead to prematurely entering a trade in a less-than-ideal setup, driven by the fear of missing an opportunity.

These emotional reactions are natural but can be detrimental if not managed. The ability to recognize these feelings as they arise and take steps to mitigate their influence is a critical skill for any trader.

Developing a strong mindset involves setting clear rules for entries and exits, accepting losses as part of the game, and maintaining patience for high-probability setups. Keeping a trading journal helps track emotional triggers and refine your decision-making process over time. Ultimately, controlling your emotions allows you to trade with logic, not impulse, leading to more consistent and profitable results.

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

Trump's Pro-Crypto Moves: The new administration is making big strides for crypto, reversing anti-crypto regulations and appointing key figures like Hester Peirce and Marc Uyeda.

THE BAD:

Uncertainty in AI Space: After DeepSeek’s launch, there is a sense of uncertainty among investors towards AI projects and they are not sure if AI projects will require high funding to build project

Big Tech Disappoints: US tech earnings missed expectations, triggering a selloff. This could be a major drag on markets if the trend continues.

THE UGLY:

China’s Economic Struggles: Despite stimulus efforts, China’s real estate and stock market woes persist. PMI data was uninspiring, and hopes for a recovery remain fragile.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter:

📈 Week 25, Trade 25 : LONG $HYPE

The latest FOMC meeting concluded without a rate cut, as widely expected, but Fed Chair Jerome Powell’s neutral stance left markets with mixed signals. While Powell acknowledged economic resilience, he refrained from providing clear guidance on future rate cuts, leading to uncertainty across risk assets. The market remains on edge, with traders closely watching upcoming inflation data and labor market trends for further clues on monetary policy direction.

At the same time, the launch of DeepSeek and Qwen by Alibaba has introduced fresh uncertainty into the AI sector. The impact was immediately felt, with NVIDIA stock taking a hit, followed by declines in other tech giants like Alphabet, Amazon, and Meta. The sell-off suggests a broader market concern over competition in AI, shifting investor sentiment toward caution. With AI stocks facing pressure and no clear direction from the FED, short-term market movements remain unpredictable.

Given these conditions, we anticipate heightened volatility in the coming days. While we remain bullish on the broader market, the immediate outlook is uncertain, requiring careful risk management. We are maintaining hedged positions and will be watching key support and resistance levels to adjust our trades accordingly.

Below, you’ll find a detailed breakdown of the latest trade and how it align with our overall strategy:

TRADE 1 : Long $HYPE Spot

$HYPE has shown strong buying support at key levels, demonstrating resilience even amid heavy selling pressure across altcoins. Despite broader market volatility, $HYPE has maintained stability, with growing community adoption and rising trading volumes signaling sustained interest in the asset.

We structured our trade as follows:

Entry Price: $21

Stop Loss: $15

Take Profit: $35

With strong community backing and increasing adoption, $HYPE remains a high-conviction trade. We’ll be closely monitoring volume trends and market sentiment to refine our strategy. Stay tuned for updates as we manage this position.

TRADE 2: $BTC Call Option $105K at Premiums 0.09 $BTC and 0.075 $BTC

The BTC Call Options from our last newsletter have hit their trigger prices. We’ve entered a long position with options expiring on March 28, 2025, aiming to capitalize on Bitcoin’s bullish momentum. Our expectation is that Bitcoin will break through the key $105,000 resistance level by the end of March.

Trade Setup:

Strike Price: $105,000

Option Premiums:

5 BTC at 0.09 BTC (executed on 26th January)

5 BTC at 0.075 BTC (executed on 27th January)

Expiration Date: 28th March 2025

Risk and Reward:

Risk: The key risk in this trade is Bitcoin failing to breach the $105K resistance level by the expiration date. In this case, the options could expire worthless, resulting in a loss of the premiums paid for the calls.

Reward: If Bitcoin does surpass $105K and maintains upward momentum, the potential for significant profits is high. As the price rises beyond $105K, these options should increase in value, leading to substantial returns on the initial premium outlay.

We’ll be closely monitoring volume trends and market sentiment to refine our strategy. Stay tuned for updates as we manage this position.

💡 CONCLUSION

This week’s trade recap highlights our focus on high-conviction plays with strong momentum in both Bitcoin and altcoins, carefully balancing risk and reward while positioning for potential upside.

Trade Highlights:

Long $HYPE Spot: Entry at $21, with a stop-loss at $15, and price target set at $35. Despite market volatility, $HYPE has shown resilience and increasing adoption, making it a strong candidate for growth.

BTC Call Options (Strike: $105K): Executed limit orders for Bitcoin Call Options at premiums of 0.09 BTC and 0.075 BTC, aiming for a breakout above the $105K resistance by the expiration date of 28th March 2025.

As we move forward, we remain cautiously optimistic about these positions, especially Bitcoin’s breakout potential. The trades have been structured with favorable risk-to-reward ratios, and we’ll continue to monitor these positions closely. The $HYPE trade reflects growing support in the altcoin space, while the BTC options play is poised to capitalize on Bitcoin’s bullish momentum.

Stay tuned for more updates and insights! You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

My 2025 Crypto Plan - Lessons, Positions and Sizing

January edition, updated as we go…

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!