📈 Week 22, Lesson 22

“Do not anticipate and move without market confirmation - being a little late in your trade is your insurance that you are right or wrong.” - Jesse Livermore

We are into Week 22 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

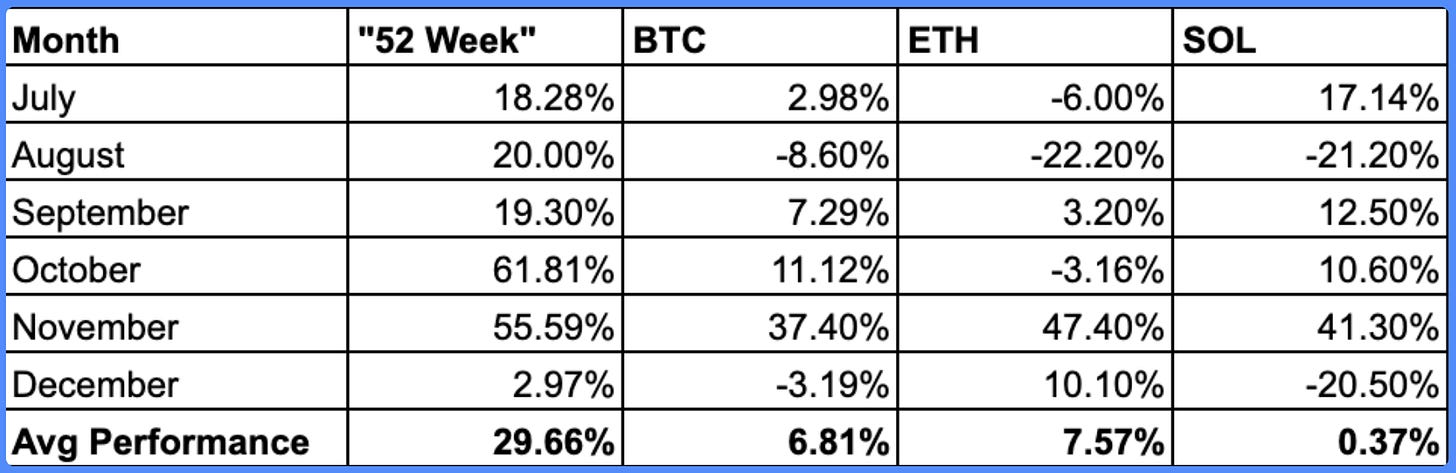

A Year In Review- Our Performance in 2024

The year 2024 opened on an optimistic note as markets witnessed a promising uptrend fuelled by renewed investor confidence. The early months saw substantial bullish momentum, offering traders ample opportunities to capitalize on market rallies. However, this rosy picture was soon tempered by the inevitable twists and turns of global events.

Political uncertainty surrounding the U.S. elections, combined with intensifying geopolitical tensions, cast a shadow over market sentiment. These factors triggered periodic hiccups and a phase of consolidation, challenging even the most seasoned traders. Despite the headwinds, savvy traders understood that market movements—whether upward or downward—hold potential for profit.

We started our newsletter in July 2024 when markets were jitterish and there was no clear direction in the market. As the saying goes, “A good trader dances to the rhythm of the market.” By leveraging market volatility in both directions, we turned challenges into opportunities, ensuring that our portfolio remained active and strategic throughout.

Overview of Trades and Performance

2024 was a thrilling, high-stakes year in the market for us. Armed with conviction, strategy, and diligence, We managed to execute 62 trades, turning the starting capital of $100,000 into a remarkable $438,987. Our strategy achieved a 661.66% annualised return and an overall 338.90% ROI. Of these, 51 trades are in profit, leaving us with a win rate of 82.26%.

*Includes Open Trades

Wins vs. Losses: Lessons Learned

Winning Trades:

The majority of profitable trades were well-researched, with strong setups based on technical and fundamental analysis. High-return trades like BTC, SOL, and FTM stood out, with some trades earning over 400% ROI.Losing Trades:

Our 11 losing trades highlighted the importance of disciplined stop-losses. Though they collectively had a lesser impact, these losses emphasized that being reactive and cutting positions early is as vital as making good entries.

Key Highlights of 2024 Trading

1. Highest Single-Trade ROI: $MORUD Spot Buy

Conviction Level: 9

Start Date: October 9, 2024

Investment: $5,000 at $0.00097 per token

Exit Price: $0.0082 (partial exits over time)

Overall Gain: 882.51% ROI

Timing and microcap research made this one of the most remarkable trades of the year.

2. Lessons From a Key Loss: $POPCAT Spot Buy

Conviction Level: 7

Start Date: November 14, 2024

Investment: $15,000 at $1.46 per share

Final Exit Price: $1 per share

Return: -30.82%

While speculative plays are high-risk, this taught me that overcommitting to mid-term recoveries can hinder returns. Diversification helped to absorb the blow.

Portfolio Diversification Strategies

Diversification Approach

Spot Trades: Dominated the portfolio with consistent returns.

Perpetual and Option Trades: Enhanced gains with leverage, albeit selectively. Examples include SOL Perpetual Long with a 35.75% gain and several options strategies.

Yield Farming: Smaller allocations to liquidity pools like SOL LP Pool provided minor but stable growth of 8-10% ROI in a few weeks.

How We Achieved Growth

Research & Analysis:

Asset-specific focus (e.g., SOL, BTC, and niche tokens like MORUD).

Combines on-chain metrics with technical analysis.

Position Sizing:

Heavily concentrated only on trades with high conviction.

Calculated risks using stop-loss strategies.

Active Trade Monitoring:

Adjusted trades dynamically; made several staggered exits to capture gains.

The 2024 trading journey was a testament to strategy, patience, and learning from losses. Each trade offered valuable lessons, sharpening our skills as an investor. Overall, this year's achievements prove that a disciplined and data-driven approach leads to outsized returns.

Staying disciplined and adaptable is key. Losses are inevitable, but how you handle them determines overall performance.

📊 Portfolio Update - Open Trades

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.

We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

Oil prices: Crude stabilised at $80/barrel, driven by stronger OPEC+ compliance.

Renewables surge: Global investments in renewables hit a record $1 trillion in 2024.

Eurozone retail sales: November saw a 2.1% monthly increase, boosting consumer sentiment.

THE BAD:

U.S. labor market: Jobless claims fell to 11 month low, increasing the chances of rising inflation again.

China exports: Exports declined by 6.7% YoY, the fourth consecutive month of drops.

Emerging market debt: High U.S. Treasury yields increased borrowing costs for EM nations.

THE UGLY:

Brazil economy: Investor confidence dropped sharply, pulling equities down by 12% in December.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 22, Trade 22 : LONG $HYPE, $GRIFFAIN, $JUP, $INJ, $ZEREBRO & $BTC CALL OPTIONS

As highlighted in last newsletter, the macroeconomic environment continues to suggest the potential for a substantial market rally. The recent pullback presented attractive opportunities, offering some excellent entry points as prices approached our pre-determined levels in our watchlist.

This week, we made strategic moves, capitalising on several opportunities from our carefully curated watchlist. Below, you’ll find a detailed breakdown of the latest trades and how they align with our overall strategy:

TRADE 1: LONG $HYPE

The market’s recent consolidation gave us a chance to add more $HYPE to our portfolio at a compelling price point. After monitoring its price action, we initiated the following trades:

Entry Price 1: $21.1

Stop Loss: $15.00

Take Profit: $50.00

$HYPE is currently trading around $22, already delivering initial gains. With its strong momentum and improving market sentiment, we expect further upward movement as it pushes towards our target.

TRADE 2: BUY $GRIFFAIN

$GRIFFAIN showed signs of bottoming near its recent lows, offering a clear buy signal. We executed the following based on our trades based on our watchlist prices:

Entry Price: $0.19

Stop Loss: $0.30

Take Profit 1: $0.75

Take Profit 2: $1.00

Currently hovering around $0.38, $GRIFFAIN’s price movement aligns with our expectations. We see further upside potential, with a strong support zone just below our stop-loss.

TRADE 3: BUY $JUP

Our analysis highlighted $JUP as a high-potential asset poised for a breakout. Its touch of a critical support level triggered our entry:

Entry Price: $0.79

Stop Loss: $0.70

Take Profit 1: $1.75

Take Profit 2: $2.25

$JUP’s current price of $0.82 indicates early signs of upward momentum. With its solid fundamentals and bullish technicals, we believe this position offers a high reward-to-risk ratio.

TRADE 4: BUY $INJ

$INJ’s recent dip aligned perfectly with our buy zone, allowing us to establish a strong position during a period of relative market calm:

Entry Price: $19.50

Stop Loss: $15

Take Profit 1: $35

Take Profit 2: $50

Trading near $21.30 at the time of writing, $INJ is showing encouraging price action. We anticipate a test of its next resistance level, driven by a broader market uptrend.

TRADE 5: BUY $ZEREBRO

$ZEREBRO has been consolidating within a tight range, and we identified an excellent entry opportunity near its lower bounds. The trades were structured as follows:

Entry Price 1: $0.29

Stop Loss: $0.25

Take Profit 1: $1.00

Take Profit 1: $1.75

Currently trading at $0.34, $ZEREBRO, with strong technical and on-chain indicators pointing toward accumulation, we’re optimistic about this position.

TRADE 6: $BTC Call Option $98K at a Premium $3.8K

We have initiated a long position in Bitcoin through a Call Option expiring 31st January 2025. This trade is structured to capitalize on Bitcoin's bullish momentum.

The setup is based on the assumption that Bitcoin will break through the key psychological barrier of $100,000, bolstered by growing institutional demand and favorable macroeconomic conditions. With Bitcoin trading close to $95,100, the strike price of $98,000 provides a minimal price gap for achieving profitability.

💡 CONCLUSION

This week’s trade recap highlights a mix of strategic spot trades and options, leveraging market pullbacks for strong entry points across $HYPE, $GRIFFAIN, $JUP, $INJ, $ZEREBRO, and a high-conviction $BTC Call Option.

Trade Highlights:

Long $HYPE Spot: Entered at $21.10 with profit targets set at $50.00

Long $GRIFFAIN Spot: Entered at $0.19 with a take-profit goal of $0.75–$1.00.

Long $JUP Spot: Accumulated at $0.79, targeting $1.75–$2.25.

Long $INJ Spot: Positioned at $19.50, aiming for $35-$50 as a take-profit level.

Long $ZEREBRO Spot: Entered at $0.29, targeting $1-$1.75.

Buy $BTC Call Option @ $98K: Capitalizing on Bitcoin’s bullish momentum and 31st Jan 2025 expiration.

Stay tuned for real-time updates and insights as we navigate these positions and prepare for upcoming opportunities. Got questions or thoughts? Reach out—your feedback is always welcome!

Stay tuned for more updates and insights! You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

My 2025 Crypto Plan - Lessons, Positions and Sizing

January edition, updated as we go…

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!