Week 20, Trade 20 : Long $BTC, $SOL, $FTM & $ETH Options

Healthy Pullback Setting the Stage for the Next Rally

📈 Week 20, Lesson 20

“In trading and investing, patience is a virtue, panic is not.” Peter Lynch

We are into Week 20 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

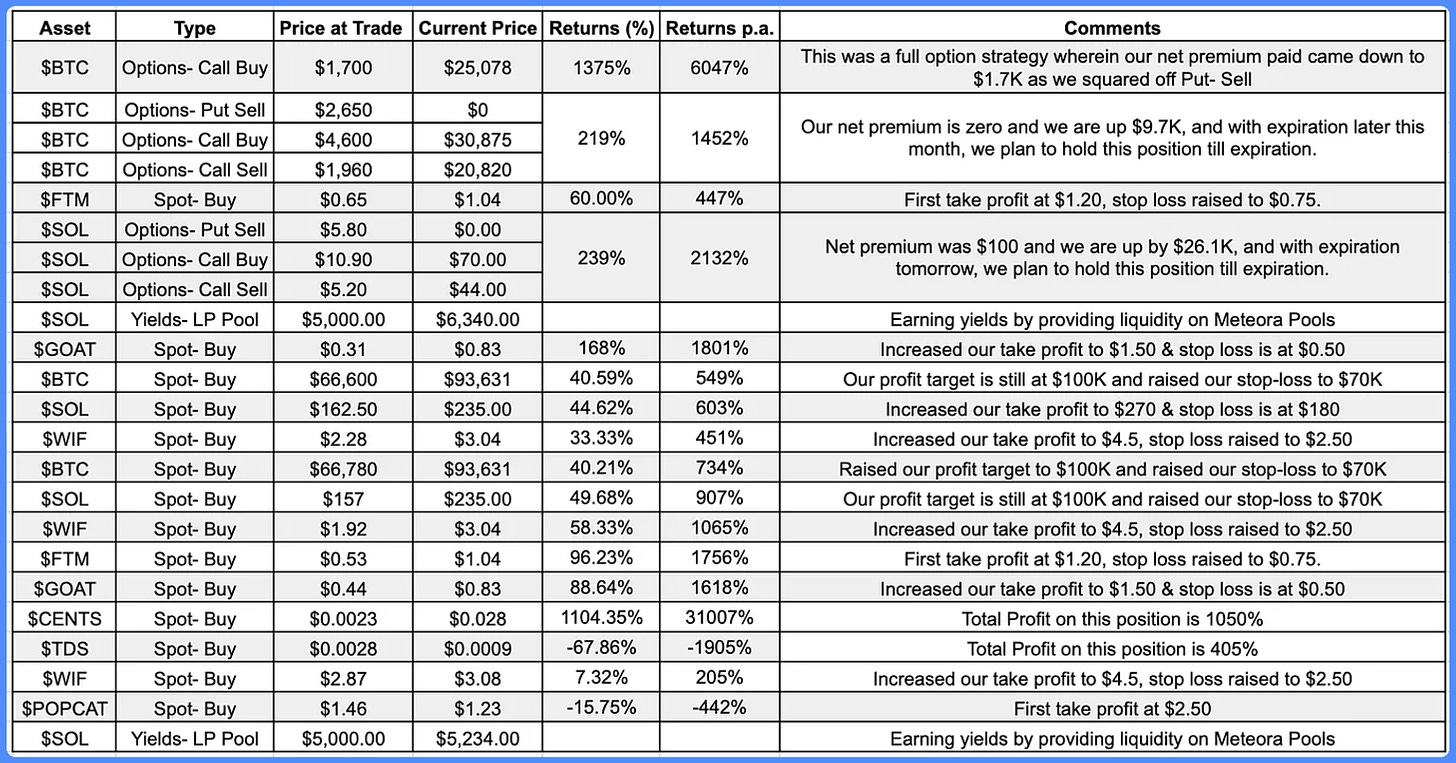

📊 Portfolio Update - Open Trades

Before diving into this week’s insights, we want to extend our best wishes for a wonderful Thanksgiving to our entire community. We’re grateful for your continued support and engagement.

As we discussed in last week’s article, we anticipated a market pullback, and with the Thanksgiving weekend now upon us & often brings lower trading volumes, and as a result, we don’t expect a significant market reversal anytime soon. Instead, we foresee some sideways movement in the market, with Bitcoin potentially dipping to $87K before regaining upward momentum.

Despite this pullback, our overall performance remains strong. Since last, our returns from inception have climbed from 318% to 326%, and our annualized returns continue to exceed 800%. Even in the face of market fluctuations, our disciplined approach has allowed us to consistently deliver outstanding results for our followers.

Now before we dive deep into the trade of the week, let’s take a closer look at our open positions:

Portfolio Update:

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

ENTRY TRIGGERS

Entry triggers are a predefined condition that prompts a trader to open a position. It represents the moment when an idea or analysis transitions into actual market participation, meaning the trader moves from being an observer to a participant.

A good entry trigger is based on clear, identifiable criteria that are consistent and replicable. It should be easy to track and journal for future reference and must align closely with the trader's original trade idea. Entry triggers should not be driven by emotions, but by logical and systematic criteria, often derived from technical setups that define clear levels for entry.

The most common entry triggers include methods such as

Outright Price,

Wick Price

Deviation

Outright price involves setting limit orders at a predetermined level, ensuring control over entry prices and enforcing discipline. While it reduces emotional decisions, it comes with the risk of no fills or partial fills.

Wick price allows for better entry prices by anticipating the market’s tendency to wick beyond key levels. This strategy often offers a tighter invalidation and is less psychologically taxing when things move as expected.

Deviation occurs when the price moves beyond the set support or resistance level, offering an opportunity to enter the trade once the price reverts back, signaling that the market has overextended itself.

Different conditions and market environments may call for different entry triggers. For example, candle close is a method where the market closes above or below a key level, confirming that the trend is likely to continue. It is easy to identify and backtest but may sometimes be slow to react, especially on higher timeframes. A low time frame fractal entry, on the other hand, combines lower time frame setups within higher time frame areas, offering a more precise entry with tighter invalidation, although it can be difficult to execute effectively. These various entry triggers allow for greater flexibility, and traders may often combine them depending on the market context to refine their entries.

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

Goldilocks Economy: The U.S. economy is in a "Goldilocks" state—no recession, stable growth, and no major policy shifts.

Trump's Appointments: Scott Bessent's appointment as Treasury Secretary would be seen as pro-growth and market-friendly, with an emphasis on recalibrating U.S. borrowing strategies and policies.

THE BAD:

The Eurozone is facing significant economic difficulties, including weak PMI data and the impact of U.S. tariffs. The European economy is in decline, with the EUR/USD exchange rate nearing parity.

Geopolitical Tensions could disrupt the positive economic momentum, potentially affecting global stability and market outlook.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 20, Trade 20 : LONG $BTC, $SOL, $FTM & $ETH OPTIONS

As anticipated, we’ve seen the minor pullback and with the holiday weekend upon us, trading volumes are likely to remain low, keeping the market rangebound. We expect $BTC to trade within the $87K-$95K range in the near term.

In this week’s Monday Macro newsletter, we emphasized that now is a good time to book some profits. You can read the full details here:

However, this doesn’t signal a bearish shift in our outlook. In fact, we believe this pullback offers an opportunity to re-enter the market, as we expect a significant end-of-year rally that could push Bitcoin past $100K.

With that in mind, we’re looking to capitalize on the current dip by securing some strategic entries. Here are our trades of the week:

TRADE 1: LONG $BTC, $SOL, $FTM & TARGET ENTRIES

With the market pullback, we have initiated three trades on $BTC, $SOL, and $FTM. Given our expectation that the market may dip further before recovering, we've also placed two limit orders for these positions. You can find the details of the trades and limit entries below:

TRADE 2: $ETH OPTIONS

$ETH has been significantly oversold, and we anticipate a potential rally. This type of momentum could be just what $ETH needs for a strong breakout.

Buy $ETH Call Option at $3,800, Expiry: 28th Mar 2025 – Premium Paid: -$463 per Option

Buy $ETH Call Option at $3,800, Expiry: 27th Jun 2025 – Premium Paid: -$673 per Option

Sell $ETH Call Option at $7,000, Expiry: 27th Jun 2025 – Premium Received: +$191 per Option

Risk and Reward:

Premium Paid: $945 for the entire option strategy

Upside Potential: If $ETH rallies above $3,800, there is unlimited upside— the higher $ETH goes, the more profit we stand to make.

Downside Risk: The maximum risk is the total premium paid, which in this case is $945.

💡 CONCLUSION

In this week’s trade recap, we’re going Long on $BTC, $SOL & $FTM along with options on $ETH, here's how it panned out:

Trade Highlights:

Long $BTC Spot: Entered at $91,056 and put two more Limit Entry orders at $88,000 & $85,000

Long $SOL Spot: Entered at $228 and put two more Limit Entry orders at $220 & $210

Long $FTM Spot: Entered at $0.98 and put two more Limit Entry orders at $0.95 & $0.90

$ETH Options Trade Breakdown

Buy Call Option at $3.8K: This option cost us $463 and gives us the chance to profit if $ETH climbs above $3.8K. Expiry: 28th Mar 2025

Buy Call Option at $3.8K: This option cost us $673 and gives us the chance to profit if $ETH climbs above $3.8K. Expiry: 27th Jun 2025

Sell Call Option at $7K: Selling this call brings in $191 and reduces the overall cost of the long call while capping gains above $7K on our 2nd Buy Option. Expiry: 27th Jun 2025

Net Impact:

The total premium paid for the strategy is $945.

With 10 contracts, the total premium paid will be $9,450.

Potential Upside: If $ETH rises above $3,800, we have unlimited upside, with the maximum downside risk limited to the premium paid for the options.

Stay tuned for more updates and insights! You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

We sat down with Akshit Bordia, co-founder of

, to explore his path from mining $BTC to leading a cutting-edge #DeFi exchange.If you loved this, you may subscribe for immediate notifications on our latest episodes!

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!