📈 Week 19, Lesson 19

"Given a 10% chance of a 100 times payoff, you should take that bet every time." — Jeff Bezos

We are into Week 19 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

📊 Portfolio Update - Open Trades

After a significant post-election rally, the market has begun to consolidate over the past week. With a thriving economy and growing confidence, both the stock and crypto markets seem primed for new highs. While another upward move feels inevitable, we may see a brief pullback before the next leg up.

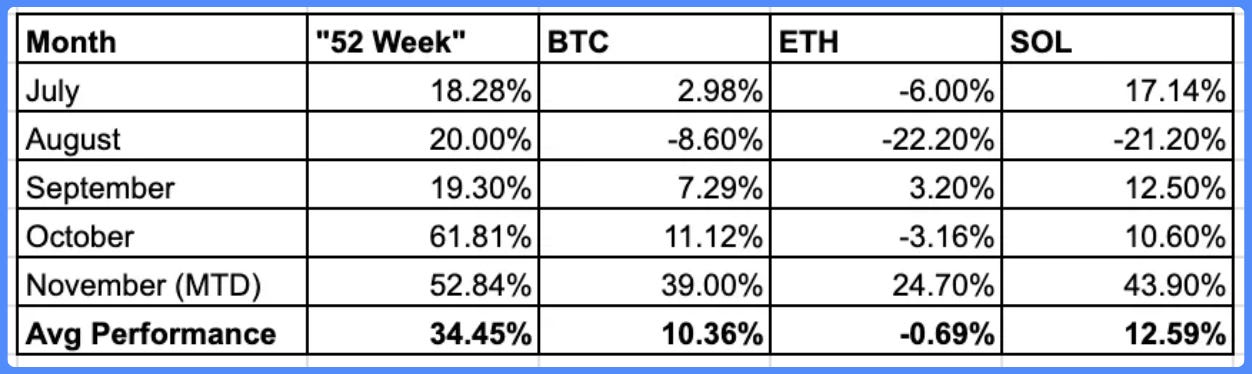

In the last week, we ventured into a few high-risk memecoin plays, which have paid off handsomely. These trades have driven our overall returns since inception to an impressive 318%, boosting our annualized returns to over 800%.

Now before we dive deep into the trade of the week, let’s take a closer look at our open positions:

Portfolio Update:

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

October’s CPI data hit expectations perfectly: 2.6% YoY headline and 3.3% core. Inflation is under control, and the Fed is in no rush to overdo things with rate cuts.

The economy is thriving, confidence is climbing, and markets are poised for new highs in stocks and crypto alike. As long as the delicate balance between fiscal restraint and monetary policy holds, this Goldilocks economy could keep the good times rolling.

THE BAD:

If tariffs are imposed by US on China, it could inject upward pressure on inflation, an unwelcome development given the Fed’s limited flexibility post-rate cuts.

Geopolitical tensions could disrupt the positive economic momentum, potentially affecting global stability and market outlook.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 19, Trade 19 : HOLDING STEADY AWAITING POTENTIAL PULLBACK

Since the election, we've witnessed an extraordinary surge in the crypto market. Many coins have reclaimed their March highs, with several reaching new all-time highs. Over the past week, however, the market has entered a more stagnant or consolidative phase, as prices have paused after a rapid ascent.

Despite this consolidation, the broader market sentiment remains bullish. We believe a shakeout or brief cooling period may occur over the next two weeks especially with the rising geo political tension between Russia & Ukraine. This pause could be a healthy pullback, creating the foundation for the next explosive move upward.

In such a scenario, a pullback isn't a setback—it’s an opportunity. When the market cools down, new windows for significant gains will likely open up, presenting us with a chance to capitalize on future momentum.

Our Strategy Moving Forward

As we anticipate this potential pullback, the strategy remains simple yet effective: hold our ground, observe the market closely, and prepare to scout for the next big opportunity. Staying patient at this stage allows us to enter at prime levels once the dust settles.

The next phase could bring even greater returns, so it's essential to stay vigilant and well-positioned for when the market reignites. Our goal is to identify the next set of winners and secure strong positions before the next major leg up.

💡 CONCLUSION

After a tremendous surge, the market is taking a breather. This is our chance to step back, reassess, and get ready for the next big move. By staying prepared and strategically positioning ourselves, we stand to benefit from the opportunities that lie just ahead.

Now is the time to remain grounded, wait for the pullback, and scout the next big trade that could deliver substantial gains.

Stay tuned for more updates and insights! You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

We sat down with Akshit Bordia, co-founder of

, to explore his path from mining $BTC to leading a cutting-edge #DeFi exchange.If you loved this, you may subscribe for immediate notifications on our latest episodes!

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!