📈 Week 18, Lesson 18

“Bull markets ignore bad news, and any good news is reason for a further rally.” Michael Platt

We are into Week 18 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

📊 Portfolio Update - Open Trades

The bull market has officially arrived, and we believe it's only going to move upward from here. It's time to settle in and enjoy what could be one of the most exciting phases in market history, with incredible opportunities ahead.

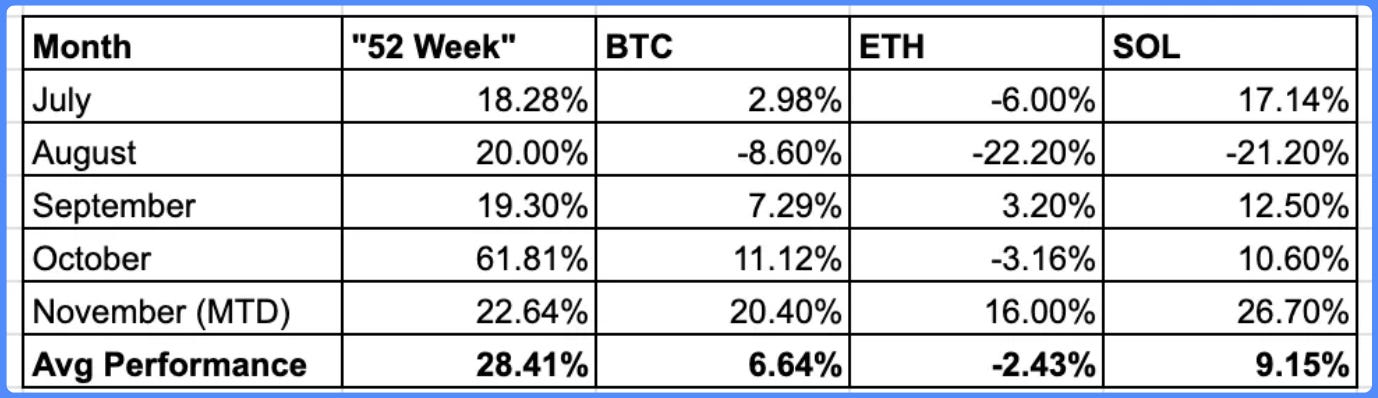

As we previously mentioned, we’re anticipating significant exponential growth in our portfolio. In just the past week, our return since inception has skyrocketed from 190% to 236%. This impressive leap has pushed our annualized returns to an outstanding 638%, reinforcing our bullish outlook.

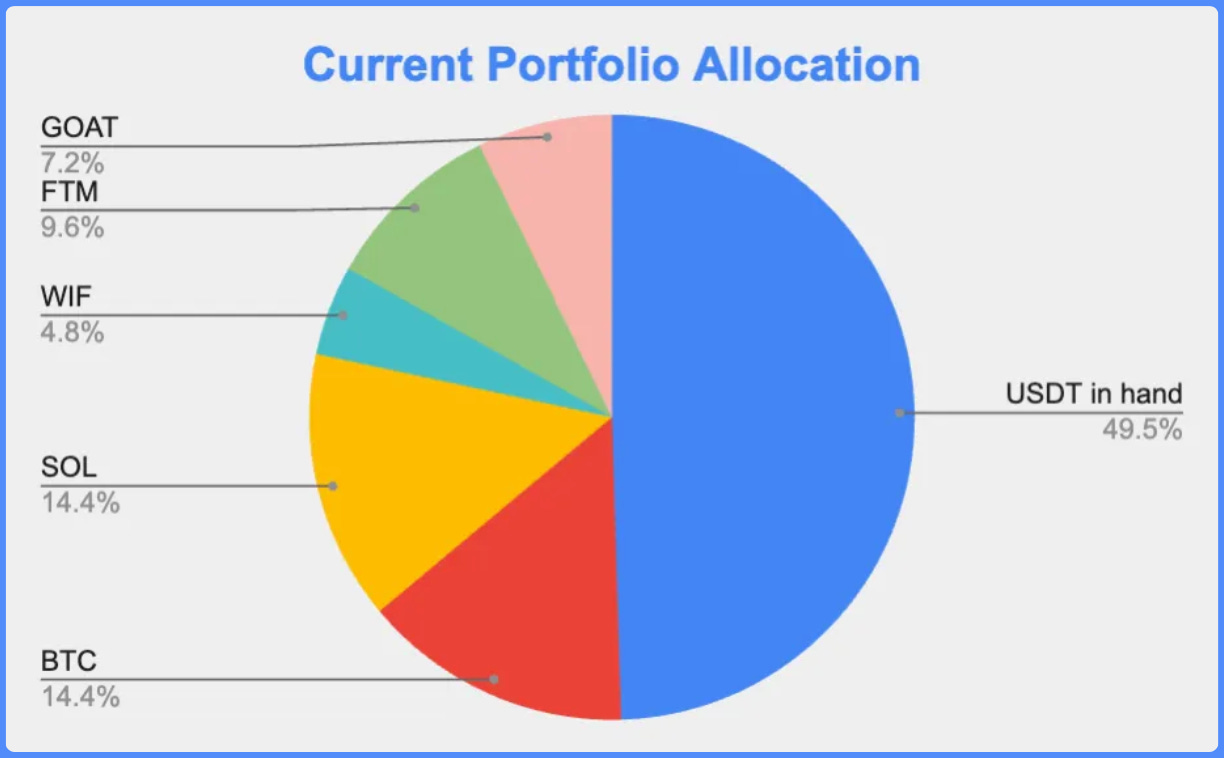

With the market momentum accelerating, we’ve already taken the opportunity to deploy a substantial portion of our capital. Over the next two weeks, we plan to further reduce our cash holdings to just 15%-20%, as we continue to capitalize on new opportunities. Here’s where our current portfolio allocation stands:

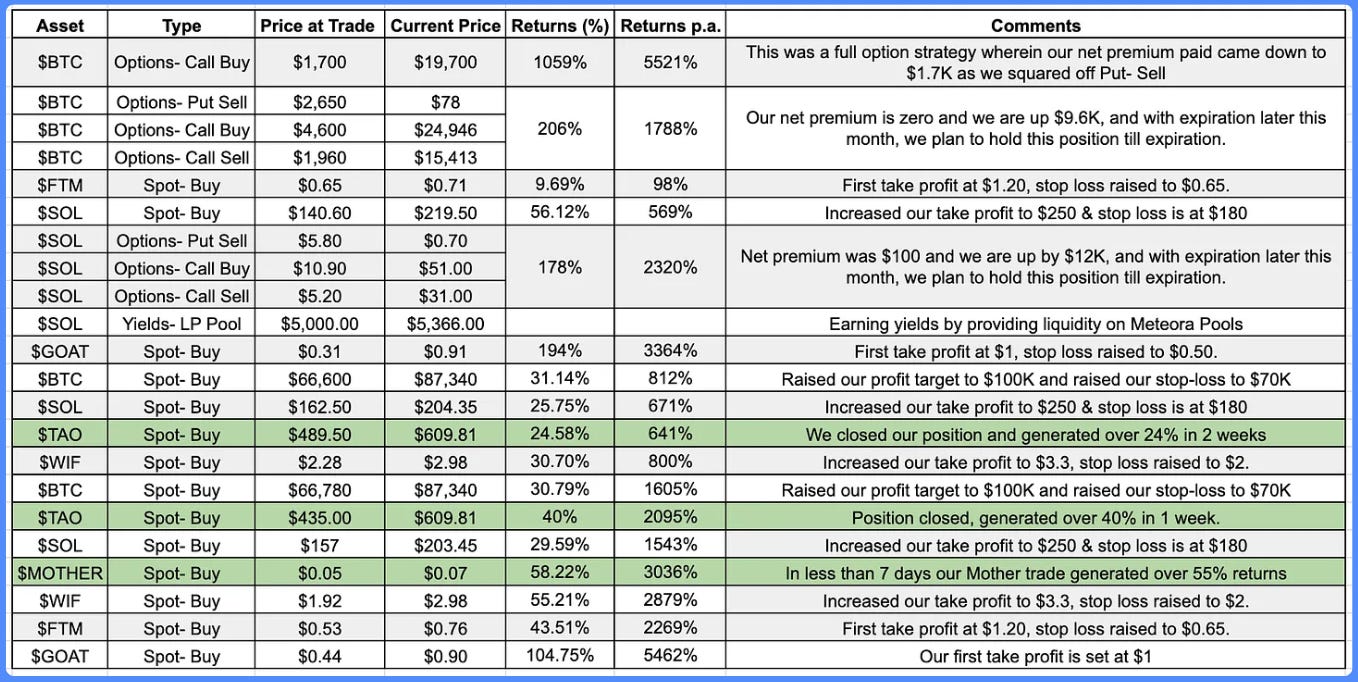

Now before we dive deep into the trade of the week, let’s take a closer look at our open positions:

Portfolio Update:

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

There are no clear indicators of a US recession, as corporate earnings and real incomes are rising, inflation is improving, and the economic growth outlook remains strong. With the election over, both consumer and investor confidence are likely to recover.

The Federal Reserve's recent 25bps rate cut to 4.50%-4.75% signals ongoing support for economic stability.

THE BAD:

The US budget deficit remains high, but it hasn’t been a major political focus, despite business leaders' concerns.

Geopolitical tensions could disrupt the positive economic momentum, potentially affecting global stability and market outlook.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 18, Trade 18: LONG $TDS, $CENTS, $WIF, $POPCAT

In the past week, we've witnessed a massive surge across the crypto market, with many major coins appreciating by an impressive 30% to 100%. With the bull market now in full swing, this is the perfect moment to pivot toward higher-risk, higher-reward plays. The market's momentum is creating rare opportunities, and for those willing to embrace volatility, the potential for significant gains is greater than ever.

Over the weekend, we shifted our focus to a select group of memecoins, as they often thrive in these fast-paced bull runs. These plays are inherently time-sensitive, and because of their rapid nature, we shared the details within our Telegram group to ensure our community had real-time access to this information.

Here’s a summary of the trades we executed:

TRADE 1 SETUP - Long $CENTS Spot

Entry Price: $0.0023

Market Cap at Entry: $2.3M

Exit Price (50%): $0.0254

Stop Loss: $0.013

Since we took the position over the weekend we have already done a 10x and we closed 50% of our position at a 10x and kept the remaining 50% for higher upside

TRADE 2 SETUP - Long $TDS Spot

Entry Price: $0.0028

Market Cap at Entry: $2.8M

Exit Price (50%): $0.0269

Stop Loss: $0.009

Similar to $CENTS, this position has also delivered a 10x return. We’ve locked in half of the profits while keeping the remaining position for future gains.

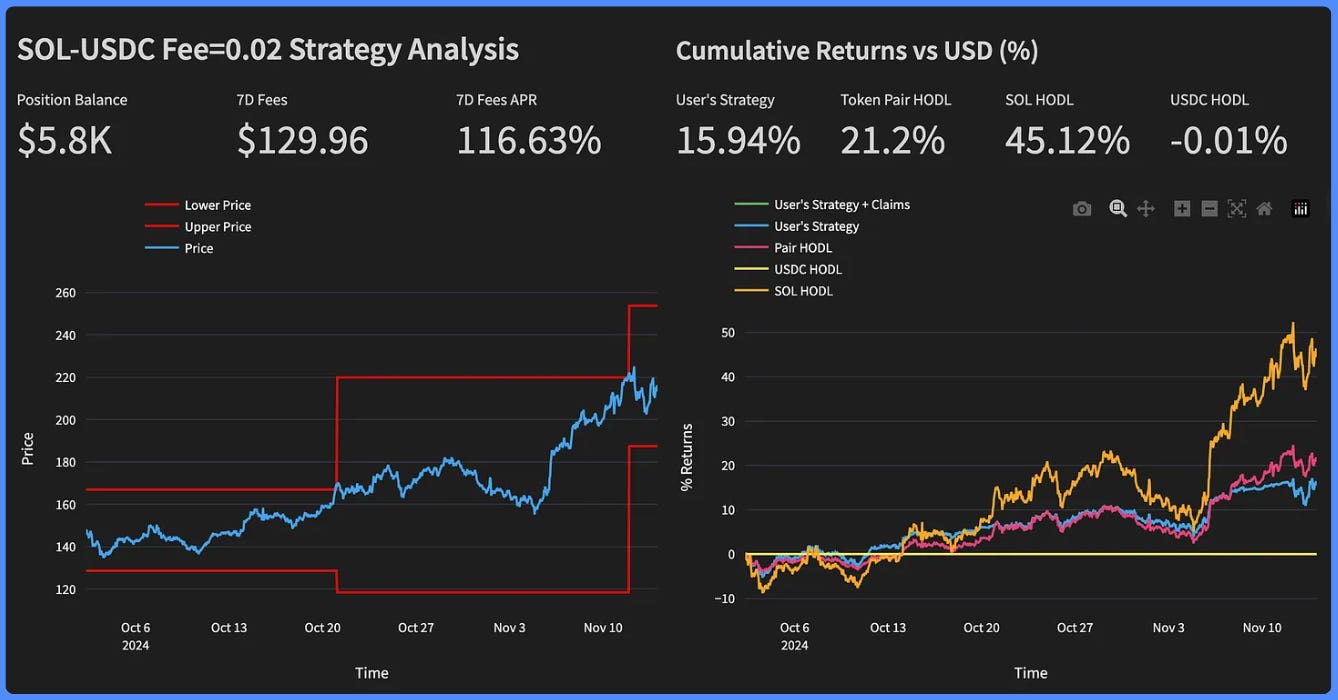

TRADE 3 - Adding up on our Algorithmic Yields on $SOL via Orca LP Pools

Our proprietary quant algorithms are hard at work, generating steady returns. We’ve added another $5,000 to our position.

TRADE 4 SETUP - Long $WIF Spot

Entry Price: $2.87

Exit Price (50%): $4.14

Stop Loss: $3.50

Returns: 45.29%

TRADE 5 SETUP - Long $POPCAT Spot

Entry Price: $1.46

Exit Price (50%): $1.91

Stop Loss: $1.50

Returns: 30.82%

With $PEPE recently getting listed on Coinbase, we saw an opportunity and placed our bets on $WIF and $POPCAT, speculating that they could be the next meme coins to get listed. This move paid off as we secured solid profits on half of our position, while letting the remaining half ride the wave.

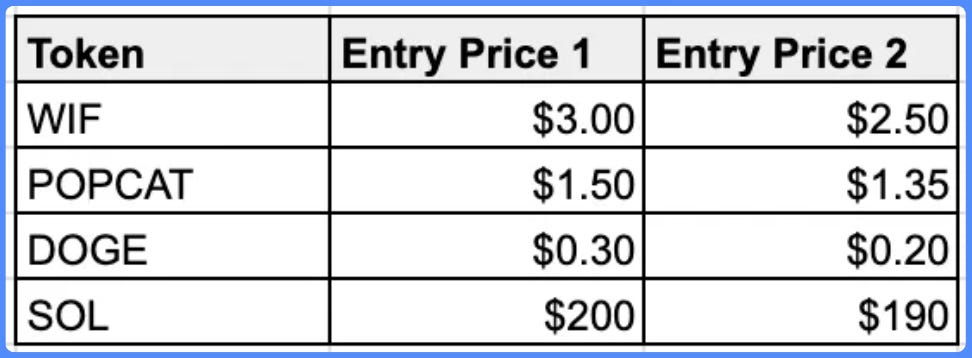

However, with the explosive run we've seen in the past week, we're expecting a potential pullback in the near term. To stay ahead, we’re building a watchlist of key tokens we believe have strong growth potential. We’re also setting bids at specific target prices to ensure we’re well-positioned for the next rally as the market continues its rapid expansion.

Watchlist with Target Entry Prices:

💡 CONCLUSION

As we wrap up Week 18 of The 52, the bullish momentum across the crypto market is undeniable. We’re strategically positioning ourselves to capitalize on this surge, focusing on high-risk, high-reward opportunities, especially in memecoins. However, we remain committed to a disciplined approach, balancing aggressive plays with strong risk management.

Trade Highlights:

Long $CENTS Spot: Entered at $0.0023 with a market cap of $2.3M. The price surged 10x to $0.0254. We secured profits by closing 50% of the position while keeping the rest for potential upside. Stop loss is set at $0.013.

Long $TDS Spot: Entered at $0.0028, market cap $2.8M. After a 10x surge to $0.0269, we closed 50% of the position and held the remainder for future gains. Stop loss is set at $0.009.

Long $WIF Spot: Entered at $2.87, after a 45.29% surge to $4.14, we closed 50% of the position and are holding the remaining half for further upside. Stop loss is set at $3.50.

Long $POPCAT Spot: Entered at $1.46, After a 30.82% rise to $1.91, we closed 50% of the position and continue to hold the rest. Stop loss is set at $1.50.

Orca LP Pools on $SOL: Deployed another $5,000, with weekly returns of 2%-3% using our quant algos.

Stay tuned for more updates and insights! You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🎙️ Podcast Spotlight: "Greed is Good" – Insights You Can't Miss!

Tech for Good: Al Morris’ Journey with Koii Foundation, Listen Full Episode Below:

If you loved this, you may subscribe for immediate notifications on our latest episodes!

⚡️ Interested in Sponsoring This Newsletter?

If you'd like to sponsor, feel free to send me a DM on Twitter: @HashtalkSankalp or simply reply to this email.

I’d really appreciate your support—consider following me on Twitter to stay updated on my journey!

💬 Check Out My Telegram Channel!

I’m excited to share that I've a Telegram channel where I share a variety of interesting content related to crypto and macro topics—tweets, threads, podcasts, articles, trades, and more.

Join the conversation here: Hashtalk By Sankalp . Looking forward to seeing you there!