Week 10, Trade 10 : Going High, High, Higher on $BTC

BTC below $55K is very attractive for now!

📈 Week 10, Lesson 10

“It is not the strongest or the most intelligent who will survive but those who can best manage change.” – Charles Darwin

We are into Week 10 of the Fifty Two Trades in Fifty Two Weeks. Thank you for reading.

“The 52” deep dives into one trade every week, targeting traders with zero or little trading experience. But I hope that my pro trader friends find this as useful. For details on why I am doing this and who is this for, please read the About section on top, which I will update from time to time.

Most trades that we take will be medium (3-4 weeks) to long term in nature. We might do some swing trading here and there if opportunity presents, but always with proper risk management. After all, our purpose is to make money, not lose sleep over it.

You can track our trades and progress live here at this Hashtalk Link

Over 10 years in banking and now 12+ years dealing with nuances of crypto, I have learned some very hard lessons. I intend to share them transparently as we go. More importantly, please keep the comments and feedback coming, so I know we are on the right track together.

Bitcoin hovering around 58K

📊 Portfolio Update - Open Trades

We started September with trades across both spot and options, with all our September positions currently open. This month, our strategy focused on the top three coins- $BTC, $ETH, & $SOL while seeking to boost returns through high-risk, high-reward plays like $VISTA, all while carefully balancing our overall risk. Despite mixed market signals, we've managed to hold our ground, with some notable wins and generating an overall return of 56% since we started in July. Below is a detailed breakdown of our current open trades:

Trade 1: Spot $MOTHER

Status: Holding 75%, Sold 25%

P&L: We locked a partial exit at $0.09 earlier and locked in a gain of 47.06% for 25% of our position. The remaining position is almost getting to back to breakeven and is only down 10% (vs around 35% last week I believe). Conviction, lads, conviction.

Trade 2: Spot $SUNDOG

Status: Holding 25%, Sold 75%

P&L: Up an impressive 600%. After exiting 50% of our position at $0.26 and another 25% at $0.32, we've locked in solid profits. Currently holding 25%, and with $SUNDOG trading at $0.32, we’re eyeing further upside as momentum builds toward a $500M marketcap. We might add this back more on any dips.

Trade 3: Spot $BNB (Entry: $530.70)

Status: Holding 100%

P&L: Conviction again guys, conviction. In hindsigh, we should have taken some leveraged positions here but macro (CPI, FED etc) were not in right place last week. However, we added more position down to $475 last week and $BNB is now trading above $550. We are up 5-17% on each position. Our plan is still the same - start offloading around $600, barring any unexpected market turbulence.

Trade 4: $SOL Options – PUT SELL

Status: Auto Closed in massive profits as term reached (13th Sept). Please see sheet

Trade 5: $ETH Options – BUY CALL, SELL PUT & SELL CALL

Status: Holding

P&L: We earned a net premium of $320 from buying & selling the options. With the price of ETH at $2,328, approx near the same price when we took the trade none of the options would be exercised on expiry (27th September). With rates cut coming in next week, we might see a move up and if ETH price crosses $2,800 we might end up making upto additional $4,000

Trade 7: $BTC Options – CALL BUY & SELL PUT

Status: Holding 100%

P&L: We bought & sold a long term option with the expiry for later this year. Idea being that we believe that market would turn bullish in the last quarter of this year and we are able to capture the upside while if the reverse happens anything below $50K is a good entry for $BTC.

Trade 8: $VISTA Spot

Status: Holding 100%

P&L: Down 17%. $VISTA has dropped to $15.55 from our entry at $20.00, but this trade is still in its early stages. We’re watching for a bounce, with a long-term target of $60.00 to $100.00.

Trade 9: Add Spot $BNB (Average Entry: $487)

Status: Holding 100%

As mentioned in our last week newsletter we took another entry at $500 and set an entry trigger at $475. Due to a liquidation wick over the weekend, we successfully entered at $475, bringing our average price down to $487. With the market stabilizing further this week, our overall position is now up by 10%. With CZ's released expected later this month, we remain bullish on $BNB.

We continue to navigate the market cautiously, balancing between risk and reward. Stay tuned for more updates as we adjust our positions based on market conditions.We’ll continue to monitor the open positions closely and adjust as needed to navigate the range-bound market effectively. Stay connected on Telegram for real-time updates and insights.

If you have any questions, ideas, or feedback, please feel free to DM me on Substack or Twitter, Let's continue to navigate the market together!

🌎 Quick Macro & Crypto TL;DR

THE GOOD:

Inflation remains under control, providing the Fed with more flexibility to act without reigniting inflation.

Despite weak economic data, markets are maintaining resilience, with Bitcoin holding strong above $50,000.

The upcoming Solana Breakpoint conference may generate renewed interest, offering potential upside for Solana.

THE BAD:

Manufacturing data continues to weaken, with the ISM Manufacturing Index signalling contraction at 47.2%.

Non-farm payrolls disappointed, showing only 142,000 new jobs and reflecting a weak labour market.

Stock markets, particularly the tech sector, faced sharp declines, with key players like Nvidia and Tesla seeing significant drops.

THE UGLY:

Job openings hit a 3.5-year low, raising concerns that the Fed may need more aggressive action to stimulate the economy.

Germany’s economic downturn worsens, with recession fears looming, threatening broader Eurozone stability.

China's slow deleveraging strategy is deflating markets but failing to offer bold, impactful solutions for recovery.

For more regular insights into macro and crypto trends, subscribe to our weekly newsletter: 5-Minute Macro and Crypto Weekly.

📈 Week 10, Trade 10: BUY & SELL $BTC OPTIONS

In this week’s trade, I’ve executed a combination of selling and buying options based on the belief that BTC will not break below $50K, and if it does, $47K is an attractive entry point for a long-term position. I’ve structured the trade to earn premium, protect against downside risks, and leave room for upside if BTC rallies.

The BTC Trade Setup:

Sell Put Option at $52K – Premium Collected: +$1.4K

Rationale: I don’t expect BTC to drop below $52K, but even if it does, I’m comfortable taking a long position at that level. As we saw last week, there’s significant buying pressure below $55K. Whenever the price dips below that, buyers quickly step in, pushing it back up before it reaches $50K-$52K. Moreover, if the price drops below $52K, the premium received acts as a buffer, effectively lowering my entry point, which we consider a strong buying opportunity as the US elections approach.

Buy Call Option at $60K – Premium Paid: -$3.3K

Rationale: This is my bullish strategy, anticipating a market rally post-FOMC towards the end of September, with momentum continuing into October as we enter the final quarter of the year. While the market may remain range-bound between $55K and $65K in September, I expect BTC to rally toward its all-time high in Q4. If BTC breaks above $60K, I’ll be well-positioned to capture that upside.

Sell Call Option at $70K – Premium Collected: +$0.9K

Rationale: To offset the cost of my long call and manage risk, I’ve sold a call at $70K. As mentioned earlier, I expect the market to rise and hover around the all-time high of $73.7K, with a potential breakout post-elections in November. While this caps my upside above $70K, it allows me to collect an additional $0.9K in premium.

All Options Expire on 25th October and we may close the trade if we see the price reach closer to $70K

Risk and Reward:

Premium Paid: By selling the put at $52K and the call at $70K, I’ve collected a total of $2.3K in premium. Since the $60K call cost $3.3K, my net premium paid comes to $1K per BTC.

Upside Potential: If BTC rallies between $60K and $70K, I could gain an additional $10K. After accounting for the premium paid, this results in a net potential profit of $9K from market gains.

Downside Risk: The primary risk is if BTC drops below $52K, at which point I’d have to buy at this level. However, I believe this is an attractive entry point for $BTC, aligning with my long-term outlook.

Why Bitcoin should be in your focus this month

$50,000-$52,000 has been a strong support for Bitcoin: It’s highly unlikely that BTC will break below $50K. Historically, September tends to be a negative month for BTC, but with c.4% drop already, further declines seem improbable. Given that October has historically been a strong month for BTC, we anticipate a rally to its all-time high by the end of October.

Potential Fed Rate Cuts: The possibility of a 25-50 bps rate cut by the Federal Reserve could act as a significant catalyst for Bitcoin. Lower rates often drive liquidity into riskier assets, such as crypto, as investors search for better yields. This could spark new buying interest in Bitcoin, pushing prices higher

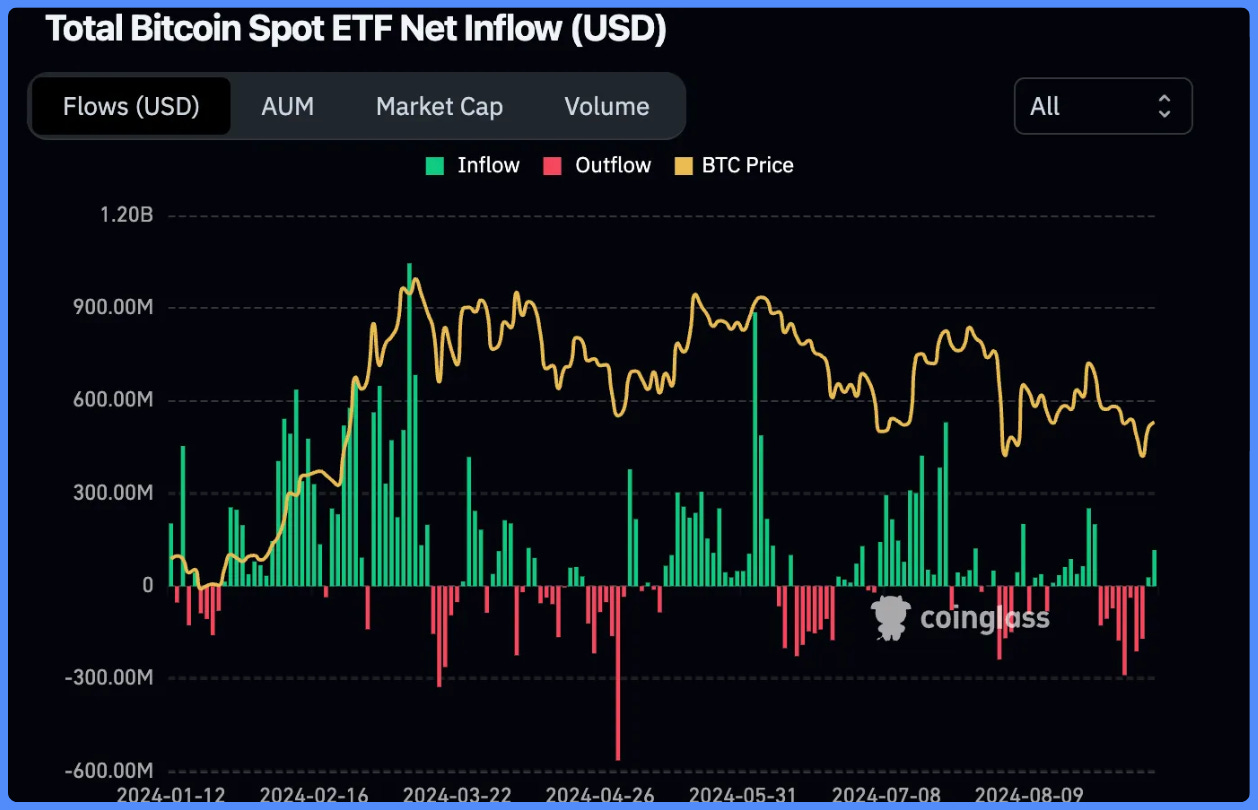

ETF showing consistent inflows and volume: Growing institutional interest and confidence in Bitcoin as a legitimate investment asset. Although BTC ETFs saw a net outflow of $1B USD over the past 8 out of 10 days, the market has since stabilized. In the last two days, inflows of nearly $150M have signaled renewed optimism among investors, driving a price increase from $53K to $56K. This resurgence suggests a stronger outlook for BTC prices in the near term.

Rise in Demand as adoption takes place: As Bitcoin adoption expands globally, from countries like El Salvador to corporate balance sheets of companies like MicroStrategy, the demand for BTC continues to rise. This growing adoption helps solidify its position in the market, pushing demand and potentially driving future price appreciation

BTC is evergreen digital gold & backbone of crypto: Bitcoin's reputation as “digital gold” remains strong, offering a secure store of value in a decentralised network. With a finite supply and widespread acceptance, BTC is the foundation of the crypto ecosystem, driving its long-term appeal as a growing and inflation-resistant asset

💡 CONCLUSION

In this week’s trade recap, we’re reviewing a recent BTC options play that netted us a tidy premium and some room for flexibility as the market moves. Here's how it panned out:

Sell Put Option at $52K: This nets us a premium of $1.4K, acting as the core income generator in the trade. By selling this put, we’re betting that BTC will remain above $52K by expiration.

Buy Call Option at $60K: This leg represents our upside exposure. While it cost us $3.3K, it positions us for profits if BTC climbs above $60K.

Sell Call Option at $70K: By selling this call, we collect another $0.9K, capping our gains above $70K but reducing some of the cost of the previous call purchase.

All the options are expiring on 25th October.

Net Impact:

We're paying a total premium of $1K for these options.

If BTC rallies, we stand to gain an additional $9K net of our premium, as our upside exposure between $60K and $70K remains intact.

While our plan is to hold these options until expiration, we may close them earlier if an early rally occurs in October.Stay tuned for more updates and insights!

You can track all our trades here.

Now go grab a coffee and please DM for any questions. Keep in mind, this is NFA and DYOR.

🤝 Discovered a great newsletter this week—”Capital Wars” - worth a read!

Check out their newsletters, and if you like what you see, consider subscribing!

⚡️ Unlock Your Advantage with Us

Building a Web3 project or want to sponsor this newsletter? Look no further.

We are your secret weapon for growth. Here’s how we help you succeed:

Engage with our 16k+ community, capturing market and mind share

Blockchain Tech advisory & outsourcing

Craft your narrative and create high-quality opportunities

Build a winning go-to-market and growth strategy

Ready to take the next step? Let’s grow together.

💬 Explore our Free Telegram Channel!

We've a Telegram channel where we daily market trends and alphas, share tweets, threads, and hot from the crypto space.

Join now and be part of our community : https://t.me/hashtalk1