Welcome to 52 Crypto Trades in 52 Weeks

Follow my trading journey as we navigate and learn about new crypto narratives, conviction, sizing, tactics, positioning, mental models, and risk management.

My name is Sankalp Shangari. I started my career in the buttoned-up world of banking, working with some of the largest European and American banks. But for the past decade, I've been navigating the wild west of crypto, dodging bullets and finding myself amused everyday. A learning that was not possible wearing a Suit.

This newsletter is my way of not just keeping my trading in check, but also sharing the treasure trove of knowledge I've gathered from my adventures in macro and crypto. Think of it as me being your crypto Indiana Jones, minus the fedora.

Every week, I'll share a new trade idea, from the lightbulb moment to execution, along with my mental models, my rock-solid convictions, strategies, and the macro and crypto narratives that guide me. Picture it as one trade a week to keep me grounded and focused—fifty-two trades in fifty-two weeks. Mostly crypto, but hey, if we find a diamond in the rough elsewhere, we’ll grab it.

I’ll keep this page updated as we go along. Perfection is like a unicorn—beautiful, mythical, and non-existent. So, here’s the basic mental model I’m following:

Current Macro Narratives: Everything begins with understanding where we are in the economic cycle. We’ll check in with our old friends—the FED, DXY, economic data, EUR, YEN, yields, and the rest of the gang.

Macro vs. Risk Assets: How does the big picture shape our riskier assets like stocks and crypto? Think of it as weather forecasting for your portfolio.

BTC & Majors: What’s the buzz with BTC, ETH, SOL, and other major players? We’ll look at flows, open interest, volumes, and narratives. It’s like checking the health stats of the heavyweight champs.

Altcoin Betas & Narratives: Scouring the middle of the curve to find the most promising altcoins each week. It’s like mining for rough diamonds in the crypto river basins.

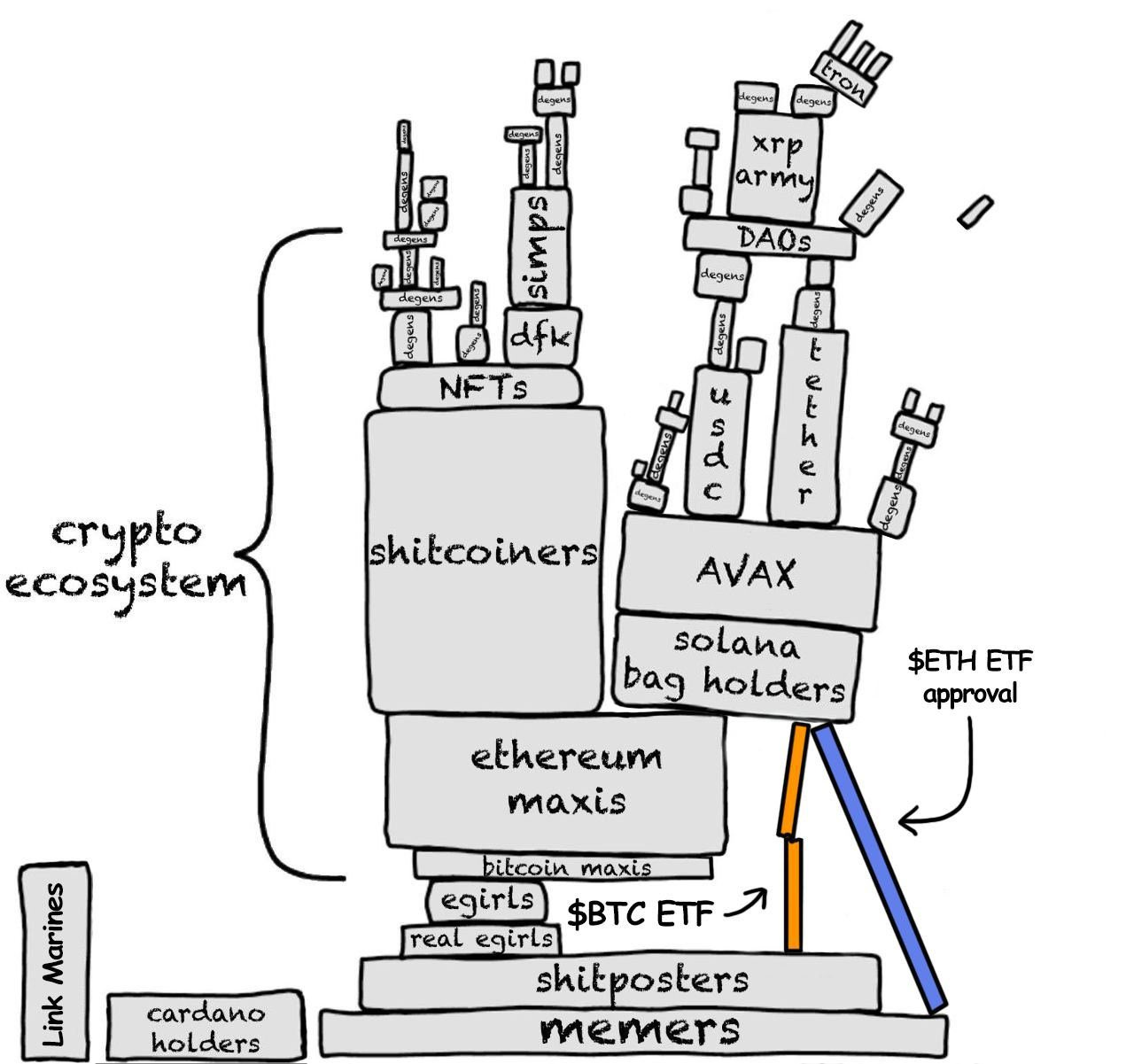

Shitcoins, Memecoins, and Lala Land: Sometimes the wildest, craziest assets can bring home the biggest wins (sometimes being the key word). This is where we get to have a bit of fun.

While I cover a lot of this in my macro and crypto newsletter each week, this newsletter will zoom in on fundamentals, technicals, sizing, positioning, and other tools. I’ll also dive into risk management—what can go wrong versus what we expect to go right. We’ll talk stop-losses, take-profits, sizing, worst-case scenarios, why a trade might flop, and do post-mortems on our existing and closed portfolios. The goal is to learn as we go, and I welcome positive criticism.

I’ll keep the trades transparent and share them live so you can track them anytime, anywhere.

You can follow me on these channels for regular insights and updates:

Twitter | LinkedIn | Telegram | Podcast

Most importantly, let’s have fun making some money.

Best regards,

Sankalp